Consider sanctions on Japan

By Jin Baisong (China Daily) Updated: 2012-09-17 07:53

The "nationalization" of the Diaoyu Islands by Japan after "purchasing" them from a "private owner" is ridiculous and cannot change the fact that they are Chinese territory.

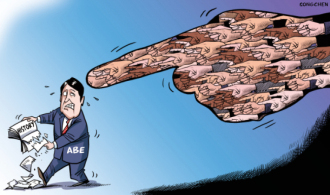

The intensifying tension between China and Japan over the Diaoyu Islands is not a farce being played out by Japanese right-wing politicians but a well-orchestrated plan of the Japanese government. China should take strong countermeasures, especially economic sanctions, to respond to Japan's provocations. Military consideration, however, should be the last choice.

To begin with, China should use the World Trade Organization's clause of "security exceptions" to impose economic sanctions on Japan.

The United States has frequently used Article XXI Security Exceptions of the WTO (taken from the earlier General Agreement on Tariffs and Trade) to impose economic sanctions on other countries. The security exception clause says a country cannot be stopped from taking any action it considers necessary to protect its security interests. That means a country can impose sanctions on enterprises, financial institutions, organizations and even other countries' central and local governments. Taking a cue from the US' practice, China can use the security exception clause to reduce the export of some important materials to Japan.

China didn't announce any sanctions against the Philippines in April, but it froze banana imports from that country in response to Manila's aggressive attitude in the Huangyan Island dispute. Though the economic countermeasure forced the Philippines on the back foot, it also harmed the interests of some Chinese enterprises.

So it is important for China to devise a sanction plan against Japan that would cause minimum loss to Chinese enterprises.

The US' capability to impose economic sanctions on other countries is based on its economic strength, huge share in global trade, financial institutions and global intelligence network. China, too, has the capability to impose sanctions on other countries now that it is the second largest economy, has the largest foreign reserves, and is the largest exporter and second largest importer.

An analysis of Sino-Japanese economic interdependence shows that Japan's economy will suffer severely if China were to impose sanctions on it. China's loss would be relatively less.

Chinese customs data show the country's exports to Japan in the first seven months of this year was $86.3 billion, accounting for 7.6 percent of its total exports. During the same period, China imported $104.59 billion worth of goods from Japan, or 10.1 percent of its total imports.

According to Japanese customs statistics, Japan exported $73.72 billion worth of goods to China in the first six months of this year, which was 18 percent of its total exports. And Japan's imports from China added up to $91.34 billion, or 20.5 percent of its total imports. This suggests Japan is more reliant on China economically.

Moreover, by the end of June 2012, Japan's investment in China was $83.97 billion. In contrast, China's investment in Japan was only $1.03 billion. And 55-60 percent of China's exports to Japan are an exchange between Japanese enterprises operating in China and Japan.

China basically exports low value-added products to Japan, which yield low profits in the manufacturing chain, while Japanese companies earn huge profits from their exports to China. That means China is in lot better position to afford a loss in exports.

Sino-Japanese trade ties played a crucial role in helping Japan avoid another recession in 2003, and have contributed 35 to 80 percent of the impetus for Japan's economic growth since then. Besides, the global financial crisis increased Japan's reliance on China for its economic well-being.

So it's clear that China can deal a heavy blow to the Japanese economy without hurting itself too much by resorting to sanctions.

Apart from its reliance on China, Japan has been suffering from other economic ills. First, Japan's massive government debt is increasing substantially. By the end of last year, Japan's sovereign debt had crossed 1,000 trillion yen ($12.81 trillion). To be precise, it was 1,024 trillion yen, or 2.2 times the value of Japan's national economy.

Second, the effectiveness of a tax increase, which Japanese Prime Minister Yoshihiko Noda has been pressing for to arrest the country's financial slide, may come to nothing. Besides, if the world economy sees a double dip, Japan's economy will slip into another recession and the effects of a tax increase will come to nothing.

Third, Japan's fiscal deterioration is likely to continue. There are enough indications that Japan's economic growth in 2013 will slow down or slip into another recession. The irreversible trend of long-term economic downturn, combined with Japan's aging population, will eat into the country's household savings, and the declining purchasing power of the Japanese will increase Japan's fiscal debt.

Fourth, according to the Japanese Ministry of Finance and the Bank of Japan, China held short-term and long-term Japanese government bonds worth 18 trillion yen ($230 billion) by the end of 2011, an increase of 71 percent year-on-year. China became the largest creditor of Japan in 2010. Given these facts, Japan should reconsider its financial health. In other words, with Japan's national debt at stake, the proverbial straw that can save the Japanese economy seems to be in the hands of China. And China can use it to find ways to impose sanctions on Japan in the most effective manner.

But instead of blindly boycotting Japanese goods, China should work out a comprehensive plan which should include imposition of sanctions and taking precautionary measures against any Japanese retaliation. China should also have several rounds of policies ready to undermine the Japanese economy at the least cost of Chinese enterprises.

Furthermore, in case Chinese enterprises suffer because of the sanctions, the Chinese government should be prepared to compensate them. And once China imposes sanctions on Japan, the government should ensure that all enterprises in the country, domestic and foreign, obey the rules.

The author is deputy director of the department of Chinese trade studies at the Chinese Academy of International Trade and Economic Cooperation, affiliated to the Ministry of Commerce.

(China Daily 09/17/2012 page9)