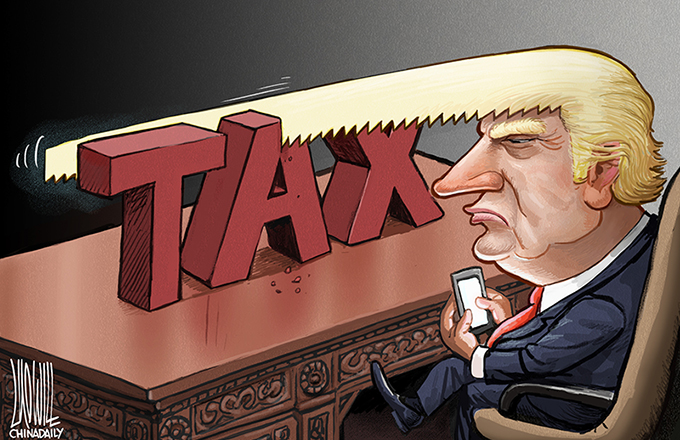

Tax exemption cannot replace structural reform

The government should further reduce the tax burden on small enterprises, said an article in China Business News (excerpts below).

The State Council decided to exempt value-added tax and business tax on small enterprises with monthly sales lower than 20,000 yuan ($3,175).

The tax exemption is a positive step. But most small enterprises that need tax relief find their sales pass the benchmark.

The government needs to reform its overall tax structure for enterprises, if it really values their role as important economic growth boosters and job creators.

Premier Li Keqiang vowed to carry out a series of tax reforms. It is expected the government will take more concrete action. If so, the small step is just the beginning.

Related Stories

Most Viewed in 24 Hours