Market volatilities shake global recovery

The G20 has its hands full. At a meeting in Moscow earlier this month, the Group of 20 nations agreed that the global economy remained "too weak," requiring greater efforts to stimulate growth while trying to ensure that recovery will not be derailed by financial market volatilities.

The global economy was weakened mainly by financial market volatilities arising from the credit crisis in the United States. The ripple effect of this crisis triggered the outbreak of the sovereign debt crisis in Europe that pushed the global economy further into recession.

This situation gave a boost to the argument for austerity, which is favored by conservative economists who contend that fiscal discipline can bring calm to the financial markets and restore confidence in the private sector. With this renewed confidence, the private sector would invest again, bringing about an increase in economic activities and the creation of new jobs.

But, as many liberal economists have pointed out, austerity administered at a time of a debt-induced recession is tantamount to economic self-flagellation. Some of them were passionate in putting forward the view that the priority of the government of a recession-hit economy is to increase, rather than reduce, spending to stimulate growth and increase employment. Bond-holders, they surmise, will only punish economies that are on the decline. Nothing wins market confidence more than a sustainable growth momentum and declining unemployment rate, they argue.

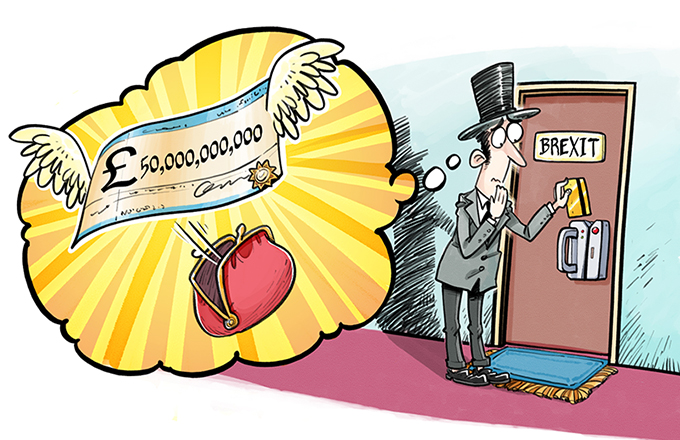

This "liberal" school of economic thinking appears to have swayed the consensus of the G20 decision-makers, as it has become clear that the austerity policies adopted by some governments, notably in the United Kingdom, have failed to produce the desired results. Instead of restoring confidence as promised, austerity has only deepened the recession, depressed investment and pushed up the unemployment rate, especially among the younger and more vulnerable segments of the population.