安倍末日 (an bei mo ri): Abegeddon

(China Daily) Updated: 2014-02-07 07:57If "Abenomics" fails to fuel Japan's economy, then the country could face "Abegeddon" and end up with a potential Armageddon story, according to UBS.

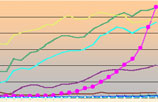

In an Abegeddon scenario, the aggressive monetary policy and fiscal expansion promoted by Abe would be pushing up Japan's debt to dangerous levels. Investors would become increasingly concerned about the sustainability of the Japanese debt, as Japan's debt to GDP ratio would rise to more than 300 percent from the current 226 percent, and the 10-year government bond yield could approach 5 percent from 0.86 percent.

After the debt expansion, Japan's economy would eventually crash if there were no follow-up stabilization policy or measures to help control the situation. Once that happened, it would severely damage the regional financial system and regional bank capital would be significantly impaired.

Given the relatively low risk of stagflation, a stampede out of government bonds may not be likely in the short term. If there were indeed any temporary sell-off, it would inevitably be curbed by Japan's central bank's stabilization measures. Therefore, it will still take years to fully judge whether Abe's economic policy is a success or failure.