|

|

|

"New normal" is a popular term referring to China’s current economy. The first time the term appeared was in President Xi Jinping’s visit to Henan this May. On July 29, Xi mentioned the “new normal” again at a meeting in Beijing while talking about the current economic situation. The question is what is this new normal state and how should China adapt to it? |

|

Characteristics |

|

The “new normal” means the Chinese economy has entered a new phase that is different from the high-speed growth pattern exhibited in the past. It is a new trend that features more sustainable, mid- to high-speed growth with higher efficiency and lower costs.

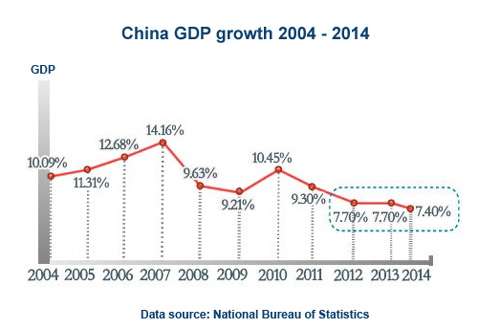

Analysts believe the new normal state has four key characteristics: Mid- to high-rate growth "The growth slowdown from a high rate of around 10 percent to now about 7 to 8 percent is inevitable," said Wang Yiming, vice secretary-general of the National Development and Reform Commission. Fan Jianping, chief economist with State Information Center, said many countries have seen their growth decelerate from above 8 percent directly to about 4 percent. The Chinese economy may grow at the mid to high speed of 7 to 8 percent for some years. Structure upgraded During the new normal state, the economic structure will undergo comprehensive and fundamental changes. The service industry will gradually become a backbone of the national economy and consumption will be the main source of demand. The gap between urban and rural areas will gradually shrink and people’s income will account for a larger share of the national economy. Amid that process of restructuring, some industries will wither and suffer from the problem of over-productivity. Meanwhile, some new growth points will spring up. New engines Under the new normal state, the Chinese economy will transform from the production investment-driven model into an innovation-driven model. From the decade between 1998 and 2008, China’s major industrial enterprises saw an annual profit increase of 35.6 percent. This number dropped to 12.2 percent last year, and further to 5.8 percent in the first five months of this year. "The prolonged difficulties facing manufacturing industries show China can no longer rely on low cost production factors, as the prices of labor, resources and land are soaring,” said Zhao Jinping, an economy researcher with the Development Research Center of the State Council. “Technological innovation must become the main driving force.” Challenges ahead The new normal state has some uncertainties and challenges. The Chinese economy has fluctuated within a comfort band this year, but the risks posed by real estate bubbles, local government debt and financial uncertainties have surfaced. Those risks are inter-related and problems in any one link could trigger a chain reaction. |

|

Reasons |

|

Potential economic growth rate (PEGR) refers to the highest possible growth rate within a certain period of time when all resources are fully allocated and used. PEGR is an ideal growth rate, and the real growth speed fluctuates around it.

The decline in China's PEGR will be an irreversible trend for a certain period of time in the future. It is decided by factors such as labor input, capital input and total factor productivity. China's working-age population (15-59 years old) shrank for the first time in 2012. It is predicted from 2010 to 2020 the country’s working-age population will decrease by more than 29 million people, which means the labor input growth will gradually slow. On the other hand, the aging population means more people need to be supported by others in the society. China was able to maintain a high savings rate and high investment ratio in the past because of the plentiful cheap labor. The savings rate will drop and the capital that can be invested will also decrease. This will make it difficult for the total productivity to rise. Due to the declining potential growth rate and increasing environmental pressure, the Chinese economy can no longer afford growth rates as high as in the past and is set to slow. In terms of structure, as supply of capital, land and other factors is on the decline and resource and environmental restriction become more serious. The proportion of the first and second industries, which consume capital, land and energy heavily and pollute the environment, will fall. The service industry, which relies less on capital, land and energy, will grow fast. The industrial structure will thus be optimized. Cheap production factors have constituted the most important driving force for China’s growth into a “world factory”. The prices of these factors increasing dramatically over the past years, has forced China to seek new catalysts. Many risks that have been hidden before in high-speed growth have surfaced gradually as the slowdown of the economy becomes inevitable. For instance, the downward pressure will weaken people’s confidence in investment and the risks accumulated in real estate market bubbles have become apparent. The real estate developers will suspend buying land from local government as home prices are expected to fall, leading to decreasing revenues of local governments and looming government debt risks. The stagnant housing market will also increase the risks in the banks’ relevant loan businesses. |

|

Influences |

|

Job creation The service sectors will provide more new jobs than the manufacturing industries. In 2012, the latter industry created about 980 jobs while creating 100 million yuan of gross domestic product. The service industry can make 1,200 new jobs. Under the new normal state, the rise of service sectors’ proportion will increase GDP and create more jobs.

|

|

Income distribution Under the new normal state, authorities need to increase people’s income, especially the low-income group, who shows stronger buying power. Without a boost in income it would be difficult boost consumption.

|

|

Extending social welfare The new normal state requires the government to cover all citizens with a basic social welfare net.

|

|

Stable growth Before the “new normal” state, the Chinese economy overwhelmingly relied on investment and export. The changes of foreign demand and investment caused fluctuations in the economy. The periodic fluctuations will become milder under the new normal state in which the economy relies more on consumption.

|

|

Stabilizing prices The stabilization of economic growth will also stabilize the price of goods. The consumer price index only increased 2.6 percent in the past two years, and 2.3 percent in the first half of this year.

|

|

Boosting innovation Innovation will become the most robust driving force for the restructuring of the Chinese economy. Growth quality and efficiency will be higher on the agenda of enterprises and the society as a whole. In general, the new normal state can boost China to transform its growth model, overcome the “middle-income trap”, and maintain mid- and high-speed growth for a considerably long time.

|

|

Opinions |

|

" The new normal state requires enterprises to develop innovations, adapt to the Internet’s influences on consumption, industry and market, and adjust their management and marketing strategies."

Li Yining, an economist and professor at Peking University |

|

"The new normal state brings two opportunities to Chinese enterprises. They can relocate labor-intensive industries overseas, and they can acquire more advanced research and development resources through merging and purchasing." "Unlike the stagnant new normal state in other countries, China’s new normal state can still ensure that the economy will grow at a normal speed. China is capable of achieving stable growth of around 7.5 percent through domestic demand and overseas investment." Justin Yifu Lin, former chief economist at the World Bank |

|

Sources: Xinhua.net, dfdaily.com, finance.sina.com.cn |