Solve income tax puzzle with fair policy

By Yang Zhiyong (China Daily) Updated: 2015-03-13 10:24

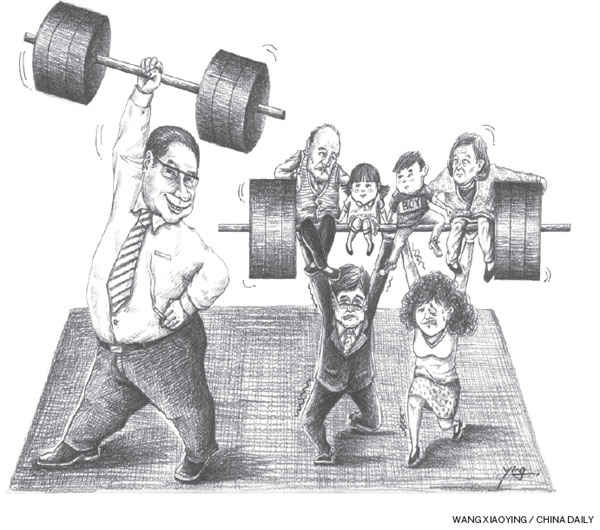

It may take a long time to fully implement a consolidated income tax system, but we could start with a combination of consolidated and classified income tax which would take into consideration family exigencies.

As a precondition for considering family exigencies, however, tax authorities must have access to detailed information on families. Apparently, it is hard to achieve this goal under the existing circumstances. At present, tax authorities' focus seems to be on enterprises and institutions, because they account for most of the tax revenue. Individual income tax accounts for only 6 percent of the overall tax revenue, with most of the individual income tax coming from enterprises and institutions that deduct it from the salaries of their individual employees.

It is thus difficult to establish a system in the short term under which income tax is imposed on families rather than individuals, because to do so tax authorities have to change the department's internal structure in order to process a huge amount of information on individual families. Also, the tax authorities have to cooperate with different government departments to streamline such a system, which in itself is a huge project demanding painstaking work.

Given China's huge population, however, it is more feasible to adopt an individual income tax system that takes family exigencies and burdens into consideration and imposes tax on the basis of families' actual monetary condition. Such a system would be conducive to fair taxation, too.

The author is a research with the National Academy of Economics Strategy, affiliated to the Chinese Academy of Social Sciences.

I’ve lived in China for quite a considerable time including my graduate school years, travelled and worked in a few cities and still choose my destination taking into consideration the density of smog or PM2.5 particulate matter in the region.