BRICS: Time for a viable ‘fast-track’ investment framework

|

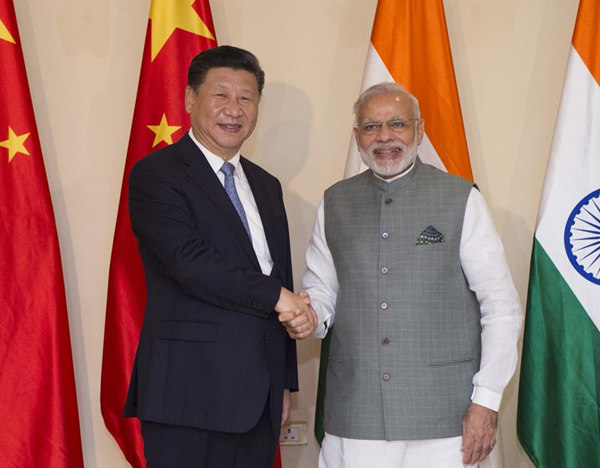

| Chinese President Xi Jinping meets with Indian Prime Minister Narendra Modi. [Provided to China Daily] |

The 8th BRICS Summit at Goa in India took place after the G20 summit in Hangzhou in September and the annual meetings of the IMF and World Bank in Washington earlier this month. Both the G20 summit and the Fund-Bank meetings reiterated the concerns of the international community over the slow growth in world trade and the increasing tendency of countries to resort to protectionist measures. The 8th BRICS Summit also noted these concerns.

World trade is currently growing at a rate lower than that of the growth in world economy. This has been happening for the last few years. The slowdown in world trade growth points to the lack of contribution of world trade to global economic growth. This is a disappointing development. Robust world trade enables most countries and businesses of the world to participate in the global exchange of goods and services for increasing their own incomes as well as incomes of their countries and that of the world as a whole. Slow trade growth does not enable such participation. With slow trade growth, world growth becomes dependent on economic performances of individual countries. Countries with large domestic economies – such as the US, China, India and Brazil – might be able to record good growth in spite of a slowdown in world trade. But many other economies – both developed and emerging market countries – would be unable to do so, given their dependence on world trade.

As a grouping of the world’s largest emerging market economies, BRICS needs to develop a strategy for tackling world trade slowdown. It is probably in this regard that BRICS members need to consider the possibility of a trade cooperation framework between them. The framework might assume any structure and can be loosely called a BRICS FTA.

Some might argue that the BRICS FTA is likely to remain as a non-starter because of the lack of geographical contiguity. While China, Russia and India can be considered neighbors in the sense of their being the largest countries in Asia’s continental landmass, South Africa and Brazil are farther away and in two different continents. However, modern FTAs between countries, including mega trade agreements like the Trans-Pacific Partnership, are not bound by the notion of geographical contiguity. Since modern trade is much more than trade in goods, and comprises trade in services, cross-border flow of capital and movement of labor and technologies, geographical contiguity is not a necessary condition for the success of a FTA.

BRICS countries already have the example of establishing the New Development Bank (NDB). The NDB reflects the ability of some of the world’s largest emerging markets to come together to mobilize finance for addressing economic challenges that are common to all emerging markets – infrastructure and sustainable development. Thus the example of BRICS members creating a cooperative economic framework is already there. The NDB can be the springboard for further economic cooperation between BRICS members.

Working towards a FTA involved many challenges. While all BRICS members are emerging markets, their economic conditions are different. These differences are most visible in their national comparative advantages. While China has great comparative advantages in export of manufacturing, Brazil, Russia and South Africa have similar advantages in several resource-intensive exports, while India has a strong comparative advantage in services. These differences might create problems between members in reaching unanimity over the elimination of import tariffs on various products. There could also be similar problems in agreeing on non-tariff barriers and regulatory standards.

A more effective way of facilitating trade between BRICS nations would be to explore the possibility of them investing more in each other. BRICS members can ‘fast-track’ investment proposals from other BRICS members and expedite capital flows by establishing common investment rules, both for investment protection as well as flow of funds. Many of these investments would encourage trade and exports. The flow of investments between BRICS member countries can be facilitated by the NDB through quick disbursement of finance for projects capable of yielding long-term investment goals.

It is important for BRICS countries to work together to address the problem of slowdown in global trade growth. But rather than moving immediately on a FTA, it might be better to pick-up areas of economic cooperation that can recharge trade. A BRICS framework for investment can be an effective idea.

The author is Senior Research Fellow, Institute of South Asian Studies, National University of Singapore.