Stable growth for greater sustainability

Mortgage loans not a magic bullet

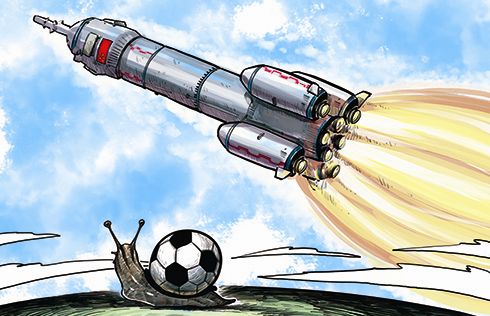

The steady economic growth in the third quarter has not only won precious time for the country to further boost domestic consumption and take up the slack for slowing trade growth. It has also high-lighted the limitations of a red-hot property market fueled by easy credit to drive overall economic growth.

Data from the People's Bank of China showed that, in the first three quarters, China's new housing loans to individuals rose to 3.63 trillion yuan ($544.3 billion), or 35.7 percent of new loans. With such unprecedented credit support, it is no wonder that the property sector has been making an "obvious contribution" to the country's GDP growth. But is growth fueled in this way desirable or affordable?

Such strong credit expansion only has a very limited impact on bolstering real GDP growth in the short term.

Even worse, the scenarios of an unchecked housing bubble that increases costs for all other enter-prises and a collapse in housing prices that leave many Chinese families and banks brutally hit would considerably undermine investors' confidence in the country's growth prospects in the mid-and long-run.

It is time for policymakers to abandon any illusion they may have that the flood of mortgage loans is a way to lift all boats.

Zhu Qiwen, senior writer with China Daily

- Chinese economy stabilizing in difficult balancing act

- Internet economy driving IT sector's wealth

- Steps planned to boost economy in the northeast

- China's economy better than expected: Premier Li

- Fair adapts to China's changing economy

- Chinese economy is stable: central bank official

- Economy tackling challenges, growing within reasonable range: Central bank governor