Concern over higher income tax fuels debate

However, China is a large nation with huge regional disparities. China's rural population is more than 600 million, including 50 million impoverished people. In a country where the per capita annual disposable income was only 21,966 yuan in 2015, an annual income of 120,000 yuan or more is definitely high.

The controversy over the definition of the "high-income group" reflects the anxiety of China's rising middle class. Those who have strong opinions on this issue are more likely to be frequent internet users with keen interest in adjustments to individual tax norms. In other words, they definitely do not belong to the low-income group. People with really low income struggle to make ends meet and don't know what happens on the internet, let alone debate the issue in cyberspace.

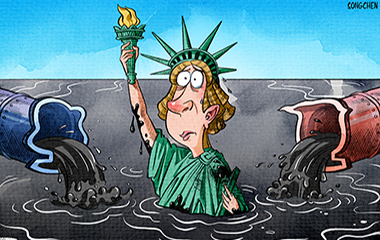

But the middle-class in the formation shouldn't take blame for the wealth gap, and they have full rights to defend their interests by expressing their opinions. In this context, quick and strong response is not only desirable but also a good thing for policymaking. The strong public reaction to the may-not-be-true information shows people lack the necessary sense of gain and security despite the comparatively high salary they earn. It is also true that the heavy economic burden owing to the rising day-to-day expenditures of individuals — such as high rents and housing loans — make the annual income of 120,000 yuan a year just enough for some residents of big cities to make ends meet.

The central government, however, has decided to expand the middle-income group as part of its strategic goal. The authorities in charge of reforming the individual income tax rules system should take people's their living expenses into consideration before increasing taxes.

Moreover, the policy asking people who earn 120,000 yuan a year or more to voluntarily declare their incomes was implemented in 2006 when Chinese people's annual disposable income was only 11,759 yuan, but the per capita disposable income has almost doubled in the past decade. And the cost of living increases even more in both urban and rural areas, yet the 120,000 yuan benchmark hasn't changed. This calls for a serious debate on taxation standards.

Individual tax reform, therefore, requires comprehensive and all-round considerations, because it concerns a majority of people's interests.

The author is a writer with China Daily

wangyiqing@chinadaily.com.cn

- 120,000 yuan not threshold for higher income tax: Xinhua

- Tax for olive-shaped society

- Promoting Tax Policies through PPP Model(No.125, 2016)

- China's tax revenue up 7% in nine months

- Stop any plan to tax online merchants: SME ministry official

- Top tax official not satisfied with tax amnesty results

- Govt mulls carbon tax by end of 2020

- Government 'mulls' consumer tax reform