After the Trump triumph

Trade conflicts - or anti-imperial realism

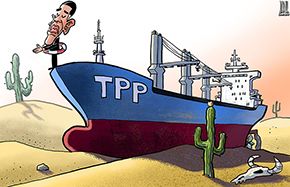

In foreign trade, Trump has pledged to tear up or renegotiate the Trans-Pacific Partnership (TPP), which would be an embarrassment to Japan and the ASEAN nations that joined the deal after years of talks.

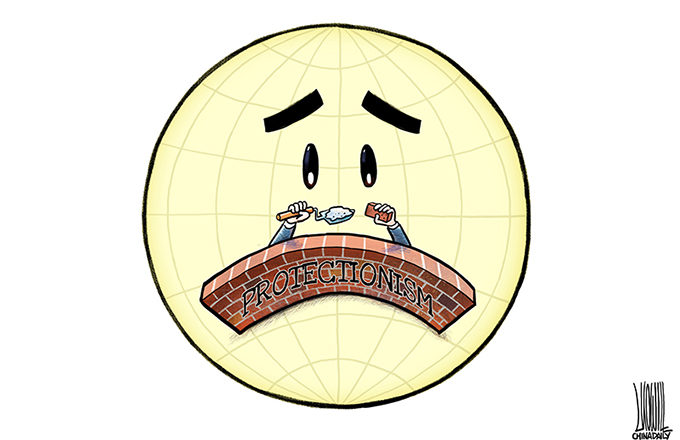

To reduce the US trade deficit with the region, he would raise trade rhetoric against China, Japan and ASEAN’s emerging low-cost producers. That would include a 45% tariff on Chinese exports and raising import duties on Japanese cars. In currency policy, he would confront Prime Minister Shinzo Abe and the Bank of Japan, which he claims are driving the yen down against the dollar. He would also challenge China’s foreign exchange reforms. In each case, the net effect would be aggravated currency friction.

Indeed, Trump’s list of foreign policy advisers - including neoconservative Walid Phares, senator Jeff Sessions, former Army lieutenant general Keith Kellogg, Blackwater USA’s Joe Schmitz, and bankers Carter Page and George Papadopoulos - suggests that either he plans to move US foreign policy further to the Reaganesque right, or that he must undermine his own agenda in due time.

The key question remains: Will Trump walk the walk? For instance, his goal to re-negotiate defense pacts in Asia would undermine the Abe administration’s controversial defense reforms.

Uncertainty - or stability

Nevertheless, there is another and far more realistic side to Trump’s rhetoric. Some of his murmurings – whether NATO is still relevant; that the Middle East would be more stable if Saddam Hussein and Muammar Gaddafi were still in power; that he could get along well with Russia’s Vladimir Putin, and so on – suggest that, in the final analysis, Trump could focus his attention on renegotiating better deals and undermining bad ones, not regime change and global empire games.

The realists of US foreign policy expect - or at least hope - that Trump could prove America’s first postwar “anti-imperial” president.

In the short term, the Trump triumph will mean economic uncertainty, market volatility, and strategic doubt. That was evident on the election day as global markets were rocked by Trump’s victory, which was accompanied by a weakening dollar, drastic declines of the Dow Jones, S&P 500 and Nasdaq, as well as markets in Europe, Asia and elsewhere.

The real question is did markets responded dramatically to anticipated future realities - or their own misguided expectations? In the coming weeks, the power transition in the White House will take place amid extraordinary political animosity and very fragile stability.

After all, Trump’s triumph has ensured the kind of political consolidation that Clinton could only dream about. As Republican majority will prevail in both the Senate and the House, Trump will take over the White House. As a result, he will be able and willing to effect real change in America - for good or bad.

Dr Dan Steinbock is Guest Fellow of Shanghai Institutes for International Studies (SIIS). This commentary is based on his SIIS project on '"China and the multipolar world economy.”