Income made via social media subject to tax

|

|

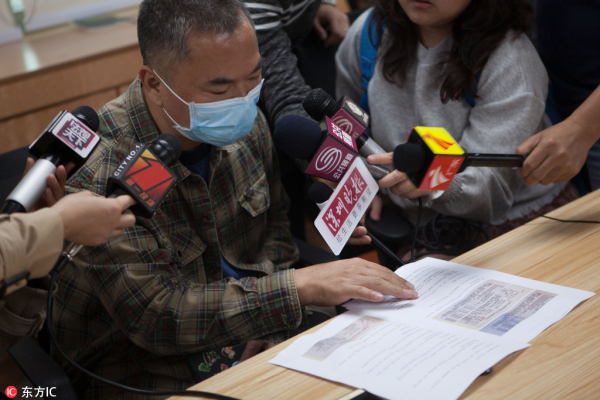

Luo Er is accepting reporters' interview during a press conference in response to his daughter's disease.[Photo/IC] |

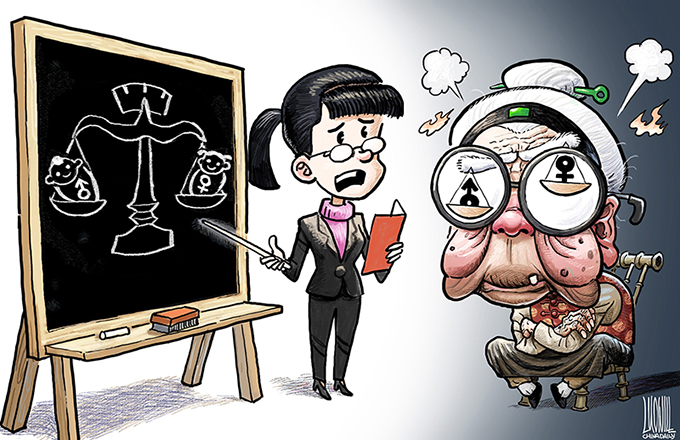

AN ARTICLE posted on the social media platform WeChat titled Luo Er Saving His Daughter attracted donations of 2.6 million yuan ($400,000) before the platform promised to refund the donors. Such appreciation bonuses are taxable income once they exceed the exemption threshold, China Youth Daily commented on Wednesday:

In its user agreement, Tencent states that those who receive appreciation bonuses for their posts on its WeChat platform are responsible to pay taxes and fees, if any, themselves. This means Tencent has no substitute role in tax liability for the posts.

At present, authors publishing via public WeChat accounts can often make up to tens of thousands of yuan a month, plus any revenue they get from advertisers. If their revenue exceeds the threshold for exemption from personal income tax, they have a legal obligation to pay tax.

If there is no sufficient supervision of their incomes, they are unlikely to voluntarily reveal how much they make knowing they will be taxed on it. For the tax authorities, the cost of active enforcement would be too great.

In order to maintain the seriousness and authority of the tax law, the taxation authority and Tencent should work together to introduce an effective means of automatically deducting payments from taxable revenues made via the platform.

- Finance ministry rolls out tax relief for debt-laden Chinese companies

- China to waive capital gains tax for Shenzhen-Hong Kong Connect

- Small-engine tax policy drives car sales

- Fears for fruit harvest over 'backpacker tax'

- New tax rate shows no quick fix to housing problem

- Favorable tax policy could be extended