IPO priority is not financial companies

TEN LOCAL BANKS as well as many securities dealers and futures brokers are reportedly in line for their initial public offering in China's A-share market, raising concerns about the shrinking market liquidity for bricks-and-mortar enterprises and innovation-driven companies. Beijing Youth Daily commented on Thursday:

Financial enterprises at all levels are striving for a place in the stock market this year, each with different intentions in mind. Most small local banks want to raise funds, while securities dealers want to further expand their business.

They have good reasons to do so as IPOs in the A-share market have become smoother during the past few months. China Securities Regulatory Commission, the top securities regulator, approved 52 IPO applications last month, marking the highest monthly total this year.

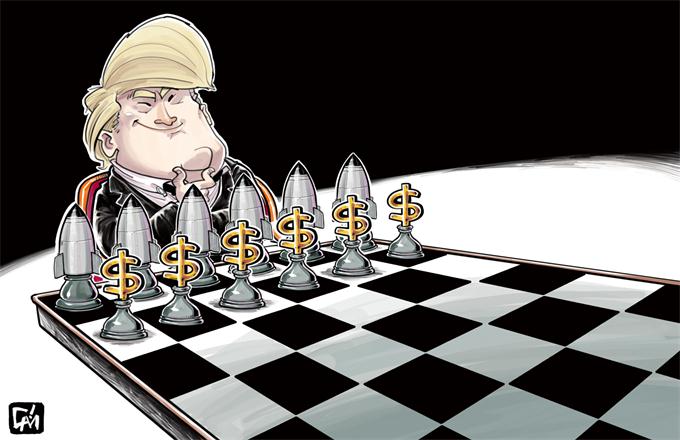

Admittedly, all qualified enterprises should be given a green light to list on the stock market. But extra caution and scrutiny are called for when it comes to the IPO applications by credit institutions, especially those financial enterprises with high and risky leverage.

In other words, their expansion ambitions should be restricted to reduce the risks of capital shortage. More important, raising money via the stock market is not supposed to become a primary financing choice for banks and brokerages.

Under the approval system for public offering of stocks, the financing channels through IPO applications are limited. As such, priorities should be given to enterprises in urgent financing need, such as bricks-and-mortars and small- and medium-sized companies with a focus on cutting-edge technologies, rather than financial institutions.

A major obstacle to the development of the real economy is the limited direct financing options available for traditional enterprises, many of which have to go through intermediary institutions such as banks, which means extra costs. Widening financial players' access to direct financing would not only make it harder for enterprises in need, but also strengthen the role of banks as financing intermediaries.

That is hardly what the stock market is designed to achieve. Besides, the necessity of restricting financial companies' IPO applications is self-evident, because they have a great appetite for stock market capital and are more susceptible to speculative activities.