Curb capital speculation in support of the real economy

It is nothing new to reaffirm the nature of housing as for living instead of for speculation. Two years ago, the State Council decided to foster housing consumption and made clear its consumption nature. It is, however, unusual that the Central Economic Work Conference, with this explicit position, gave a strong signal that the central government will no longer tolerate the property market bubbles and capital speculation, and all financial, land, tax and legislation measures will be prepared for this purpose. It is expected that more policy tools, including heavy taxes on house trading profits, will be on the horizon so as to make it unprofitable at all.

Another priority is a strong emphasis on fostering the real economy. Instead of the hot media words of internet finance, virtual reality, sharing economy and so on, the conference put quality and core competitiveness at the central piece. It means that in the real economic sectors must rely on advances of technology and productivity. What is equally import, the conference did not mention internet plus, but stresses the growth of strategic emerging industries on the one hand, and the upgrading of traditional industries on the other. In recent years, remarks either by the State Statistics Bureau or local governments tend to mention the growth of strategic emerging industries while neglecting the traditional ones. Don’t forget: the strategic industries only accounted for 11.2% of total above-scale industrial output added value in 2015. If there is no growth in the traditional industries, even if the former grows at 15% per year, total industrial output added value could only grow by 2% per year, making 6.5% GDP growth rate unattainable.

The conference calls for “craftsmanship”, brand build up and fair competition for small, medium and micro business. In this regard, we should learn from the German “invisible champions” who are mostly small business, rely on the world's finest craftsmanship and offer excellent products with world famous brands.

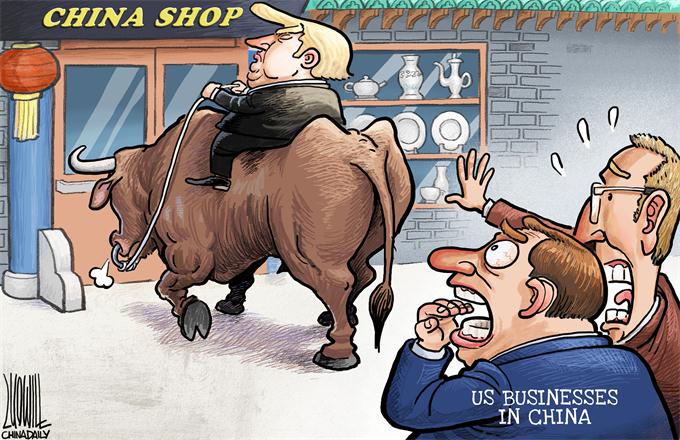

Internet finance, which is an extremely hot word in China, is not mentioned in the official news report of the conference. Instead, it calls for further improving the governance architecture of the state-owned commercial banks and promoting development of private banks. The private Sunning Bank, approved right after the conference, will focus its business both online and offline on supporting the real economy. Another clear signal is thus given that internet finance, while a new model of financial activity supported by internet technology, is only a tool of finance. The financial services, be it online or offline, must serve the real economy instead of a capital movement chasing profit only.

Looking into 2017, the Chinese economy, in the process of further supply-side reform and structural changes, must be anchored on a sound real economy, with maximum technology support and minimum property bubbles and capital speculation. Only then, a stable growth at 6.5% (GDP growth rate), with less financial risks, could be secured.

The author is vice president and senior fellow at the Center for China and Globalization.