Fundamentals support the rise of Chinese robotics

|

|

MA XUEJING/CHINA DAILY |

In the new and emerging industry, the rise of innovative robotics startups heralds the future. Last year, almost 130 companies were funded by venture capital, including China-based RooBo, Israeli Roboteam, and German ReActive Robotics. While the most valuable deals involved unmanned aerial systems companies (read: drones), they were followed by agricultural robotics, service robots for businesses and personal use.

The total amounted to almost $2 billion, 50 percent more than in 2015.

As emerging industries diffuse to mass markets, innovative startups typically become acquisition targets by major corporations that seek to consolidate the rapidly growing industry. Last year was a milestone for such acquisitions in robotics and automation with 50 companies sold for more than $19 billion.

The top five transactions totaled more than $1 billion each, including German KUKA, which was bought by China's Midea Group; the Luxembourg-based Dematic (German Kion Group); and the United States-based Intelligrated (Honeywell).

Aiming at leadership, KUKA is absorbing new businesses. As a winning German company, it was known for reliability. As a winning Chinese company in global markets, it must achieve lower costs.

As evidenced by the boom of innovative startups, venture capital funding and industry acquisitions, global robotics is the new technology frontier. Past investments by Chinese industry leaders, central and local government agencies and universities are paying off. Industrial robots beat all other categories last year in terms of output growth-integrated circuits, motor vehicles and mobile telephones-expanding by more than 30 percent.

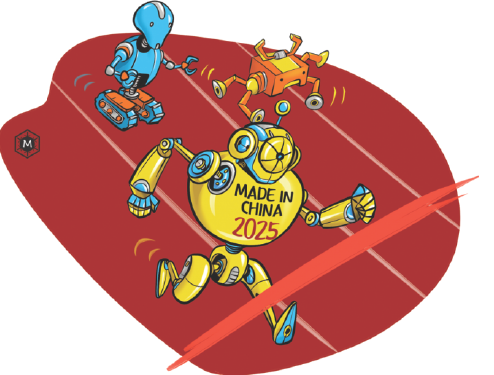

Until recently, Chinese industrial robots were still relatively simple. Today, China is rebalancing from a low-cost "world factory" to a world-class advanced-manufacturing power, which is precipitated by new technology-related initiatives, including Strategic Emerging Industries, Sci-Tech Innovation 2030, Internet Plus, and Made in China 2025. At the same time, Chinese industry leaders are moving from low prices to world-class innovation.

But market leadership will not come without competitive friction. And as global robotics are consolidating, rivalries are about to become tougher.

In 2015, worldwide sales of industrial robots soared to 254,000 units. In global robotics, the key competitors are the US, Japan (and to a degree, South Korea), Europe and China. The US is most capital-intensive. Japan stresses innovation. Western Europe exemplifies greatest intensity (high ratio of robots per population).

Nevertheless, as the largest growth market, China is moving toward production leadership. US dominance in the automotive industry is no longer immune to competition, as evidenced by the 2016 purchase of US-based Paslin by Zhejiang Wanfeng, a subsidiary of a Chinese car parts supplier. The KUKA acquisition is boosting Midea in rivalry with Japanese innovation.

Last year, markets were dominated by European and North America (80 percent), with Asia lagging far behind (20 percent). Yet the uptake of industrial robots is accelerating regionally. In the first half of the 2010s, the annual supply of industrial robots rose by 70 percent in Asia/Australia. In 2015, China's robot density was ranked only 28th in the world, but it is targeted to more than quadruple by 2020, as Chinese industry leaders said at the recent robotics summit in Shanghai.

Moreover, the regional strengths of incumbent robotics leaders are eroding, due to international uncertainty and US protectionism. In Europe, the risk of regional disintegration complicates industry leaders' efforts to achieve scale and scope. In North America, the White House's protectionism has potential to undermine the very market US multinationals rely on for their leadership, as well as their sales in international markets. Due to its stagnation, Japan needs external growth, which was expected from the Trans-Pacific Partnership agreement that the US exited in January.

In contrast, China's large-scale capital markets are still in their early phase and have a lot of room to grow, unlike in the US. The same goes for Chinese robotics density, unlike in Europe. Relative to Japan, China continues to grow four-to-five times faster. And while Washington is pushing for new barriers, Beijing is pushing for new globalization and regional growth, both of which will facilitate the rapid rise of new industries.

Indeed, the fundamentals of the emerging industry and economic realities are supporting the rise of Chinese robotics in a way that is no longer possible for other major industry players.

The author is the founder of the Difference Group and has served as the research director at the India, China, and America Institute (USA) and a visiting fellow at the Shanghai Institutes for International Studies (China) and the EU Centre (Singapore).