Proposed EU regulation will harm foreign investors

|

|

Chinese Premier Li Keqiang delivers a keynote speech at the 12th EU-China Business Summit in Brussels on June 2, 2017. [Photo provided to chinadaily.com.cn] |

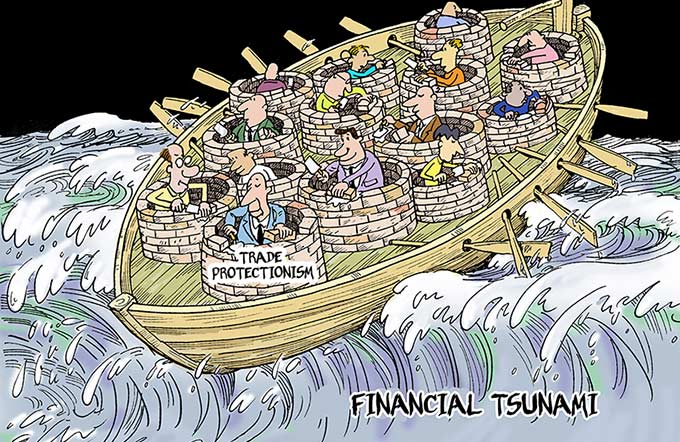

Last week, the European Commission proposed a draft regulation to assume greater power in approving foreign direct investment in the sectors which could affect security and public order. The regulation will come into effect only after the European Union member states and the European Parliament approve it.

According to the draft, sectors such as energy, transportation, communications, data storage, financial infrastructure, artificial intelligence, robotics, semi-conductors, cybersecurity, and space and nuclear technology are key areas that need stricter monitoring and supervision. And foreign investors could be prevented from investing or doing business in those areas for "security reasons".

The EC says that since less than half of the EU states have a strict national screening system in place, more coordination is needed at the EU level to minimize the threats to the EU's security and public order. Other developed economies such as the United States and Japan have already established such screening systems to "safeguard" their national interests.

The EU debate on the issue started months ago. And many believe China is the main target of this move, as some policy advisers have publicly presented papers saying China's share of total foreign investment in the EU has been increasing while that of the United States and Canada is decreasing. But if the EU leaders take this argument as the basis of their decision, they would be adopting a discriminating approach to foreign investors and grossly compromising the bloc's principle of open economy.

Besides, the fact that the EC has proposed such a regulation at a time when the EU economy has recovered raises some serious doubts as to its real intentions. The EC says the proposed regulation is aimed at making policies more certain, but in effect it seems disruptive.

Why didn't the EC make such a decision between 2008 and 2012 when the EU economy was in deep trouble? Then, the EU spread the proverbial red carpet for Chinese investors and welcomed their help to solve its financial woes.

Arguing in favor of the draft regulation, some say the EU is worried about the increasing number of takeovers by China's State-owned enterprises in Europe, and the proposal will make the screening procedure stricter to ensure EU interests are protected. Such worries are unnecessary, because China's SOEs are no different from other multinationals and many are listed on the New York or Hong Kong stock exchange. These enterprises have a corporate management structure and are highly competitive thanks to decades of reform.

Given these facts, by blocking their entry into the EU, the EC will be depriving the EU states of a big opportunity to attract Chinese high-end companies to boost the competitiveness of their businesses and to create jobs.

In his annual state of union address last Wednesday, EC President Jean-Claude Juncker explained the regulation thus: "If a foreign, state-owned company wants to purchase a European harbor, part of our energy infrastructure or a defense technology firm, this should only happen with transparency, with scrutiny, and debate."

If Juncker studies the case of COSCO, China's State-owned shipping giant, he will realize that the company has breathed new life into Piraeus Port in Greece after its takeover. Of course, the port needs more time and business to flourish, which it will certainly do in the course of time.

Juncker should also acknowledge that despite being an open and competitive destination for foreign investment, the EU is an expensive and complicated market full of rising challenges of terrorism and immigration.

The EU decision-makers therefore should carefully study the pros and cons of the proposed regulation, and if they realize it will harm investments and investors both, they would do well to drop it.

The author is deputy chief of China Daily European Bureau.

fujing@chinadaily.com.cn

- EU may cut back on foreign direct investment

- China raises concern over EU investment screening initiative

- China extends anti-subsidy duties on EU potato starch for 5 years

- Study: China-EU partnership a start

- China, EU can grow role: report

- EU treads political path to Korean Peninsula resolution

- Major business and innovation zone supports Sino-EU trade growth