Tentative measures to support and encourage industries in BDA (summary of policies)

Enterprises that apply for industrial support and encourage must meet all the following requirements:

1. be an independent company;

2. register, pay taxes, produce and operate in BDA;

3. in accordance with the direction and priorities of industry development in BDA

Newly introduced Global Fortune 500 enterprises or China’s Fortune 100 companies, which are in the top 10 industries or possess national famous-brand products, can apply for funding support of not more than the enterprises’ annual rent after paying taxes after researching, developing and producing in rent factory buildings. The term of the support is no more than three years.

Newly introduced manufacturing-type enterprises that need to purchase land and build factories, can apply for funding support within five years of their registration, according to 50 percent of income taxes BDA gains from relevant enterprises.

The following new introduced enterprises – headquarters or regional headquarters of multinational companies, headquarters or regional headquarters of group corporations, research and development centers, marketing centers, settlement centers, logistics centers, service outsourcing enterprises, assets management companies (AMC), venture capital firms, and other high value-added producer service firms –can apply for funding support within five years of registration, according to 100 percent of income taxes BDA gains from relevant enterprises.

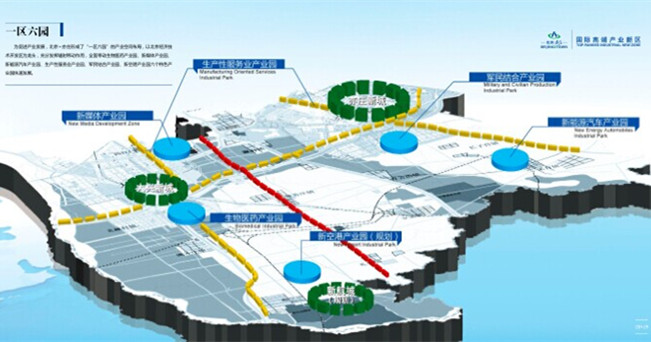

The Area with Six Parks

The Area with Six Parks Global Top 500

Global Top 500