China stabilizing foreign trade through taxation

China’s State Taxation Administration recently announced that it will come up with ways to increase the efficiency of its export rebates, facilitate foreign trade, and sustain growth in foreign trade, to speed up the rebate process and ensure full reimbursement and stop people from delaying the process, with help from the Internet, data and cloud computing.

The tax system will go online to increase efficiency and ensure accuracy, while the taxation treasury bank is expected to get into electronic online operations for greater efficiency and if the rebate allowances are insufficient, it should reported immediately.

The tax administration will have a zero-tax or duty free policy for added-value exports, and tax refunds for outbound tourists. It is also expected to support small-to-mid-sized enterprises in entering international markets and tracking new problems with export tax rebates or exemptions.

The administration has also called for a cross-border e-commerce tax policy and more innovative tax rebate mechanism to make room for cross-border e-commerce development and for the elimination of the paper version of export goods declarations and for late declaration of overdue export rebates to reduce company tax burdens.

The administration has cited illegal export rebates and has asked personnel to focus on risk management to keep things from getting worse.

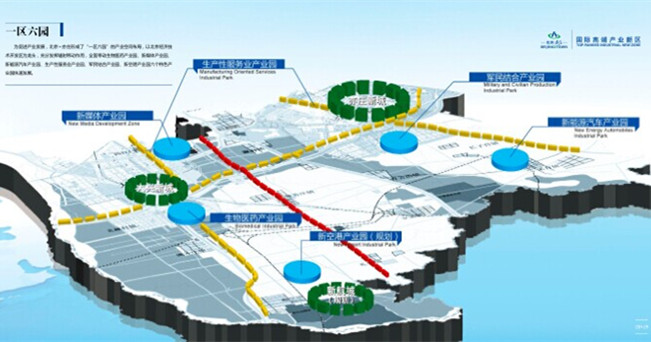

The Area with Six Parks

The Area with Six Parks Global Top 500

Global Top 500