Figuring the future of financial technology

( China Daily Europe )

The world is experiencing a digital upheaval. Financial technology (fintech) is one of the products of the digital revolution. Fintech refers to the technologies that can be used in the financial sector to help traditional companies innovate.

Figures from data analysts CB Insights show that fintech companies globally made 653 deals worth $13.8 billion (12.93 billion euros; 11.02 billion) last year, which is twice the total volume of 2014. Based on these figures, the United States is the global center of fintech. The United Kingdom is the center of the fintech industry in the Europe, while China is the center of the fintech industry in Asia.

The US and China have a very close business relationship in the fintech area. For example, JD.com and Baidu Inc are investors in the US company ZestFinance.

The UK has smoothly implemented policies that are used to support the development of fintech companies in the British Commonwealth countries.

With the development of information, communications and technology (ICT), the fintech industry will expand in the future. It will not only appear in new niche markets, such as peer-to-peer (P2P) lending but will also have great influence on traditional financial markets.

In the future, the development of fintech will have different characteristics due to three main elements: the financial environment, technology and innovation.

The current financial environment determines the main direction of the fintech industry and the target market of fintech companies. For example, the US financial services system is quite mature and covers a relatively broad range, so there is not much room for fintech companies to serve personal clients. Up until now, most US fintech companies have been invested in or purchased by traditional financial institutions and serve them. However, China is still a developing country and its financial market is awaiting development. The fast pace of urban life creates a desire among individuals for convenient financial products. This creates huge opportunities for fintech companies in developing countries.

Regarding technology, the key to competitiveness in the financial industry is the ability to receive, process and deeply analyze, so ICT technology is very important. Artificial intelligence (AI) will probably become the basis for all industries, as with the internet. If AI is applied in the financial sector and commercialized, the world's financial services will be more personalized and costs will be reduced. However, the US still has the best ICT technology and many great companies, such as Google. However, China is also very likely to make a great contribution to the AI technology and could probably be the best source of AI finance.

Innovation is essential to the development of the fintech industry. At present, developed countries, such as the US and UK have better innovation skills than developing countries because of their policies, education systems, knowledge transfer rate, capital, ability to commercialize and their fintech companies' ability to attract venture capital.

There is great potential for global cooperation in fintech. But different countries could have very different development trends. Developing countries, such as China, will focus on the individual financial service sector. Fintech companies will make simple, standard, user-friendly financial products and services and turn niche markets into big-scale markets. But in the developed countries of the West, the fintech industry will focus on the transition and upgrading of traditional financial companies.

The authors are researchers at the Hande Institute of Finance in Shenzhen. The views do not necessarily reflect those of China Daily. )

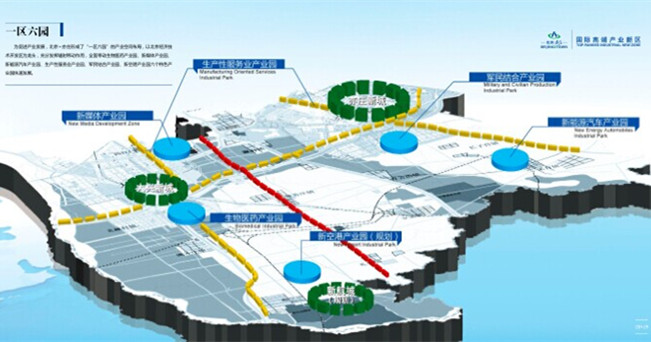

The Area with Six Parks

The Area with Six Parks Global Top 500

Global Top 500