China set to gain lead in flat-panel production

( China Daily )

China is expected to replace South Korea as the world's largest flat-panel display producer in 2019, an industry report said.

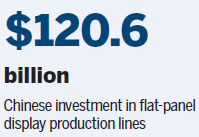

The nation has invested 800 billion yuan ($120.6 billion) in flat-panel display production lines, with investment in liquid crystal display (LCD) panel production exceeding 500 billion yuan, according to the China Video Industry Association and China Optics and Optoelectronics Manufacturers Association.

Statistics also showed that revenue from the country's display industry topped 200 billion yuan last year, and shipments of display panels reached around 57 million square meters in the first half of 2017, accounting for one-third of global shipments, second only to South Korea.

Display panels are widely used in the television, PC, smartphone and wearable device sectors.

"With production lines reaching mass output in the fourth quarter, the shipment of display panels will continue to grow," said Yi Xianjing, deputy research director of display device and system department at consultancy All View Cloud in Beijing.

Yi added the prices and shipments of traditional LCD panels will rise this year.

"We are confident that Chinese display manufacturers will break the monopoly of South Korean companies in the area of flexible display panels for smartphones this year."

An earlier report from research and analytics firm IHS Markit said China will dominate flat panel display manufacturing by 2018, taking up 35 percent of the global market.

In a move to break South Korea's stranglehold in AMOLED, or active matrix/organic light-emitting diode technology, which is used in high-end smartphone screens, such as the iPhone X and Samsung's Note 8 series, Chinese panel manufacturers are pressing ahead with ambitious expansion plans, investing heavily in new flexible display panels.

BOE Technology Group Co Ltd, the country's biggest display producer, is muscling into the market. The company invested 46.5 billion yuan in a sixth generation AMOLED production line, which was rolled out in May, at its Chengdu factory. It can turn out 48,000 glass substrate panels per month.

BOE expects to ship about 90 million AMOLED display screens per year, while its Mianyang's new line is slated to start production by 2019.

Market research firm IHS Markit has forecasted that BOE will become the world's largest supplier of AMOLED display panels in 2019.

Shenzhen China Star Optoelectronics Technology Co Ltd, another Chinese display panel manufacturer, started construction of a sixth-generation LTPS-AMOLED display panel production line in June in Wuhan, Hubei province.

Chen Lijuan, an analyst at Sigmaintell, said panel manufacturers should not just invest in production lines, but also pay more attention to the establishment of a whole industry chain, including raw materials, equipment and technology.

fanfeifei@chinadaily.com.cn

(China Daily 10/11/2017 page14)

The Area with Six Parks

The Area with Six Parks Global Top 500

Global Top 500