Sector predicts slower moving sales growth in current year

( China Daily )

Car sales in China edged up to a record 28.88 million units last year-but the growth rate plunged to a meager 3 percent year-on-year, the lowest point in six years-according to the China Association of Automobile Manufacturers.

The association also expects the growth rate to hover at a similar level in 2018.

"The growth rate in 2017 fell short of our 5 percent estimate, mainly because the purchase tax discount is losing its effect and China's adjustments to its new energy car policies at the start of the year affected sales to some extent," said Chen Shihua, an assistant to the secretary-general of the association.

Introduced in late 2015 to buoy up weak market demand, the 50 percent discount on the usual 10 percent purchase tax on cars with engines no larger than 1.6 liters, one of the most popular segments in China, once worked like magic.

In 2016 it conjured up 21.4 percent growth year-on-year for sales of cars eligible for the discount, which brought about a nearly 15 percent growth in passenger cars sales overall but sapped some market demand in 2017.

As a result, passenger cars, which take up the lion's share of total car sales, totaled 24.72 million units last year, up 1.4 percent year-on-year, the lowest point since 2008, Chen said.

A breakdown showed that sedan sales dipped 2.5 percent to 11.84 million against the previous year, MPV sales fell 17 percent to 2.07 million and minivans slumped 20 percent to 547,000.

SUVs were a rare and consoling exception. Their sales grew 13.3 percent year-on-year to 10.25 million units in 2017, most of which were produced by Chinese carmakers.

A report by the CarBingo Academy found SUVs are the top choice for a majority of car owners considering a second vehicle for the family, a sentiment that sustained the segment's high-speed expansion in past years.

"For those families who already own sedans, SUVs offer a different feel and use, despite a riding experience that isn't as comfortable," said Xu Gang, a Shanghai-based partner of Boston Consulting Group.

He said SUVs also appealed to first-time car buyers with their trendy silhouettes and commanding views.

The China Association of Automobile Manufacturers estimated that in the current year SUV sales would lose their momentum a little, with their growth rate falling by 2 percentage points to 11 percent year-on-year.

One thing that may serve as a harbinger is that Great Wall Motor, China's largest SUV producer, saw its sales fall 0.4 percent in 2017. Its small-sized H1 model nosedived in sales by nearly 73 percent, and even its best-selling compact H6 fell more than 12 percent.

An annual survey in 40 cities by the China Automotive Technology & Research Center found that Chinese customers were getting less satisfied with micro and small-sized SUVs available in the market.

"It's a timely warning to the carmakers. Customers buy small-sized cars, but that does not mean they are less demanding about what they buy," said Fu Lianxue, an official at the center.

His words were echoed by Li Qingwen, president of Car-Bingo Academy.

"Chinese carmakers responded fast to local market trends like SUVs, so they could develop fast in the past decade," Li said.

"But they have to elevate their product quality to meet future challenges. There won't be a clear distinction between customers' expectations for Chinese and foreign volume brands."

Despite an overall sagging market, premium brands were unscathed. In fact, most of them made remarkable progress last year.

Daimler AG sold more than 610,000 Mercedes-Benz and smart-branded cars last year in China, up 25 percent year-on-year. Jaguar Land Rover sales grew 23 percent to 146,399 cars, accounting for nearly a quarter of its global sales. The British carmaker also expects to further improve its market performance in 2018.

China has become the largest retail market for Cadillac, the premium arm of General Motors, where its sales soared 51 percent to 175,489 cars last year, beating its home country the United States.

Another highlight of the Chinese market is new energy cars. A total of 777,000 new energy cars were sold in 2017, a 53.3 percent surge year-on-year, according to statistics from the China Association of Automobile Manufacturers.

Xu Haidong, an assistant to the association's secretary-general, expected their sales would grow at around 40 percent to exceed at least 1 million in 2018-as the cars continued to gain wider recognition among the public and the authorities pushed their development.

China has built the largest public charging network worldwide, according to Liu Kai, an official at the China Electric Car Charging Technology and Industry Alliance.

Liu said by the end of 2017, China was home to 213,903 public charging poles and 231,820 private ones.

The alliance estimated that by the end of December China had more than 1.72 million new energy cars on the road, of which nearly 1.5 million were electric. It has been the largest market for such cars since 2015.

Yang Jing, an official at the China Car Consumer Research and Testing Center, said currently buyers of new energy passenger cars were primarily well-educated residents in tierone and tier-two cities, with the majority of them aged between 30 and 40.

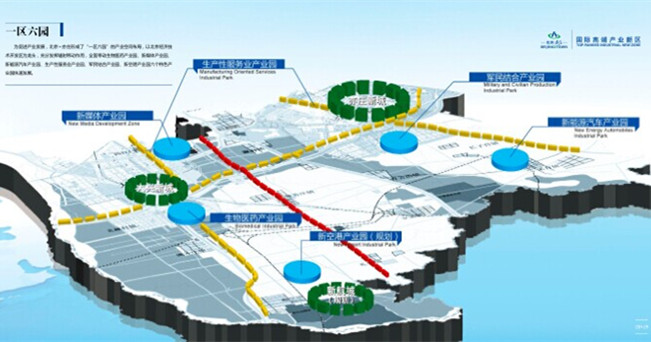

The Area with Six Parks

The Area with Six Parks Global Top 500

Global Top 500