Reforms given credit for increase in central SOE profits

( China Daily )

China's central State-owned enterprises saw their highest profit growth in five years as well as a drop in the ratio of liabilities compared with assets in the first quarter, the country's top SOE regulator said on Monday. The change was credited to the country's new round of reform and opening-up.

Central SOEs saw profits rise by 20.9 percent year-on-year to 377.06 billion yuan ($60 billion) between January and March, up from 15.2 percent for 2017, according to the State-owned Assets Supervision and Administration Commission.

The average asset-liability ratio for central SOEs stood at 65.9 percent by the end of March, down by 0.4 percentage points compared with the beginning of this year.

To ensure healthy growth, Peng Huagang, deputy secretary-general of the commission, said central SOEs have earnestly implemented the requirements for deleveraging, strictly controlling the scale of interest-bearing liabilities, supplementing equity capital through multiple channels and continuously optimizing the asset-liability structure.

The government will also impose targeted regulations on different types of SOEs this year depending on their debt risk. For example, it will introduce stricter regulations on SOEs with both higher debt ratios and deleveraging difficulties.

Peng said central SOEs' emerging industries and new products and types of businesses have been driven by sound macroeconomic fundamentals, enabling them to develop rapidly in the first quarter.

Those in military industries have doubled their efforts in military-civilian integration, speeding up the commercialization of research and development findings and actively exploring new businesses, including intelligent manufacturing, smart security equipment and remote sensing satellites.

The revenues generated by these new businesses accounted for more than 30 percent of the central SOEs' total. New businesses such as data, information and communications technologies in central telecommunications SOEs saw fast growth of 13.4 percent year-on-year. Those revenues accounted for more than 51 percent of those companies' total revenue.

Peng said central SOEs will continue opening up to increase imports and expand cooperation with other firms.

The country's central SOEs will form a purchasing team to seek cooperation on imports and in other fields at the first China International Import Expo slated for November in Shanghai.

Under the government plan, central SOEs will implement opening-up policies to expand foreign investors' shareholding in certain sectors.

Li Jin, chief researcher at the China Enterprise Research Institute, said breaking the monopoly and boosting competitiveness is the key to China's SOE reform.

"The key is whether they are globally competitive and are getting more efficient," said Li.

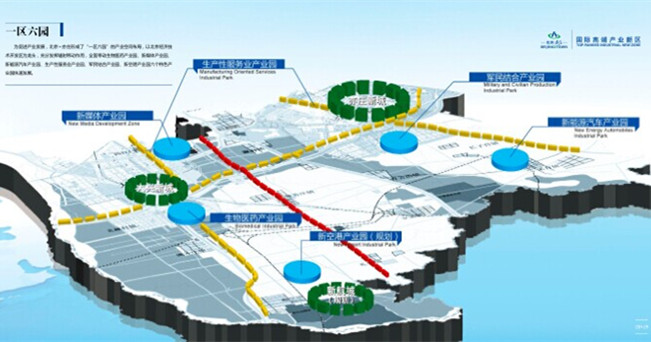

The Area with Six Parks

The Area with Six Parks Global Top 500

Global Top 500