Display screen firms eye growth

( China Daily )

Chinese companies are looking to take a share in the flexible display screens market, which is surging due to the proliferation of electronic devices, experts said.

Key to those flexible screens is organic light-emitting diode technology, which was a main focus of the 2018 Society for Information Display Week at the Los Angeles Convention Center from Sunday through Thursday.

The annual event, co-sponsored by Display Supply Chain Consultants, also featured exhibitions, symposiums, courses and presentations by the world's leading display companies.

OLED technology, first developed in 1987 by chemists Ching W. Tang and Steven Van Slyke at the Eastman Kodak Co in Rochester, New York, is a display technology used on the screens of smartphones, laptops, televisions and other devices.

"I think the advantage the new Chinese companies have is that there is a rising demand for OLED, but there are not enough companies able to fill the demand," said Sri Peruvemba, executive board member and marketing director for the Society for Information Display.

Compared with older, more common liquid-crystal display technology, OLED is an energy-efficient alternative that enables manufacturers to produce a thinner screen with more colorful images and wider viewing angles.

As a result of that flexibility, many manufacturers have used the technology to develop transparent and bendable screens.

According to Allied Market Research, a company that studies business trends, global revenue of the OLED market will reach $37.2 billion in 2020, with estimated 18 percent growth till 2020.

South Korean and Japanese companies, such as Samsung, LG and Panasonic, account for the majority of that revenue, but experts said that more Chinese companies are entering the market.

A report from Display Supply Chain Consultants showed that Chinese OLED shipments jumped 124 percent to $11.7 million in the fourth quarter of 2017, and are expected to rise 143 percent in 2018 to $28.4 million.

Leading Chinese OLED manufacturers include Visionox, BOE and Royole. Visionox and BOE displayed their products at the conference.

"OLED attracts people not only because of its advantage in the cellphone market, but also because of its potential to become foldable," said Yan Ruoyuan, Visionox executive vice-president.

Visionox, formed by a research team at Tsinghua University in Beijing, has 22 years of OLED manufacturing experience.

Yan said Visionox's customers include Nokia and Garmin, and the company is looking for opportunities in North America.

"The US is a very important electrical consumer market. Even if a majority of the OLED companies are in Asia right now, this is a global market," Yan said. "The US also has big potential clients such as Apple, Microsoft and Amazon, so for Chinese display companies like us, the US is a market that we definitely won't miss (out on)."

Peruvemba said Chinese companies have experience from building LCD factories in the past.

"I think the biggest investments in OLED are happening in China," Peruvemba said.

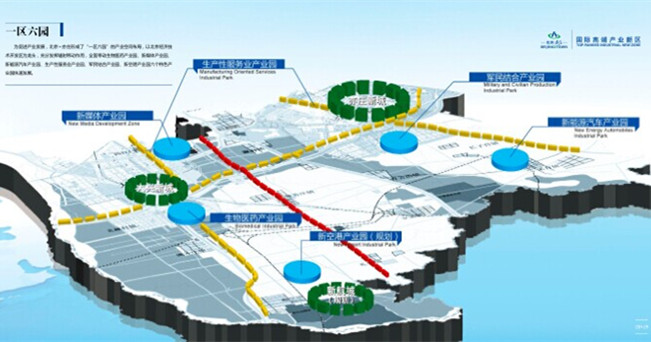

The Area with Six Parks

The Area with Six Parks Global Top 500

Global Top 500