Growth strong despite SUV sales dip

( China Daily )

The growth rate in sales of SUVs in China was overtaken by that of sedans in May, the first time in almost seven years, as overall sales grew steadily in the country.

A total of 2.28 million vehicles were sold last month, up 9.6 percent for the same period last year, according to statistics from the China Association of Automobile Manufacturers.

Thanks to the May sales, total vehicles sales grew 5.7 percent in the first five months of the year to 11.79 million.

To the surprise of many in the industry, sedan sales in May leaped up by 12.1 percent on the same period last year to 940,000 units, while the SUV segment seemed to lose momentum, growing 6.5 percent year-on-year to 761,000.

The SUV segment had retained a much faster growth rate though when the first five months this year were combined. Its sales grew 11.7 percent from January to May to 4.22 million while sedans rose 4.8 percent to 4.73 million in the same period.

"It is understandable that SUV sales growth has slowed a little bit after years of surging ahead," said Xu Haidong, an assistant to the association's secretary-general.

SUVs, because of their higher-seating position, spaciousness and some off-road capabilities, have been popular in China in recent years.

Sales growth for SUVs soared 36.19 percent year-on-year in 2014, 59.93 percent in 2015 and 43.41 percent in 2016, before falling to 13.32 percent in 2017, according to the Economic Observer newspaper.

The popularity has enticed many brands, especially international ones, to introduce SUVs into their lineups.

Volkswagen AG, with its Tiguan already proving popular in the market, is planning to introduce at least 10 Volkswagen-branded SUV models into China by 2020.

General Motors Co told China Daily late last year that about a third of its future Chevrolet models in China will also be SUVs.

It is not clear that whether SUV growth rates will continue to slow, but analysts say that it would be extremely hard for them to skyrocket like they did in previous years. "As sedans have long occupied the lion's share of the passenger car segment, many carmakers are renewing their sedan lineups to seize a larger market share," said Xu.

He was echoed by Cui Dongshu, secretary-general of the China Passenger Car Association.

"It is not something accidental that sedans surpassed SUVs in sales growth. This would be a turning point: SUVs will not soar and skyrocket as they did before and sedans will start to reinforce its position," said Cui in an interview with the Economic Observer.

Sedans have remained the most popular choice in China over the decades although they have been losing ground to SUVs in the past few years.

Last year, sedans, despite a 2.48 percent fall, accounted for 47.93 percent of 24.71 million passenger cars sold in the year, while SUVs, after a 13.32 percent rise, seized a 41.4 percent share.

Despite the slowdown of SUV sales growth, some analysts said there is still huge potential for them.

Because of limits on the release of license plates placed on big cities, smaller cities and rural areas are rising as important markets for carmakers and because of poorer road conditions, people there are more likely to choose SUVs.

Some industry insiders even insist that over time, SUVs will overtake sedans as the best-selling passenger car segment in China.

The market share for sedans shrunk to 47.78 percent by the end of May from 47.93 last year, while SUVs' share inched up more than 1 percentage point to 42.69 in the same period.

As sedans and SUVs vie for the top spot, sales of multipurpose vehicles and minivans have continued to fall.

MPV sales in the first five months of the year totaled 753,000 units, an 11.1 percent fall year-on-year, and minivans saw an even steeper 30.1 percent slump to 191,000 in the same period.

Demand for new energy vehicles, which consist of electric cars, plug-in hybrids and fuel-cell cars, is continuing to grow.

A total of 102,000 units were sold in May, up 125.6 percent year-on-year.

Sales in the first 5 months reached 328,000 units, a 141.6 percent increase year-on-year.

The association said it is confident in new energy cars and expects sales this year to exceed 1 million units. China sold 777,000 such cars last year.

The country overtook the United States as the world's largest new energy car market in 2015.

Charging networks for such vehicles have also been growing steadily.

In May, more than 4,100 public charging poles were built, bringing the total in the country to 266,231, according to the China Electric Vehicle Charging Infrastructure Promotion Alliance.

The number of private charging poles in the country totaled 441,422 as of last month.

Commercial vehicles, including buses and trucks, have also recorded a decent sales performance so far this year.

In May, 398,000 vehicles were sold, an 18.6 percent rise on the same month last year.

That brought sales in the first five months to 1.89 million units, up 3.4 percent year-on-year.

Of these, bus sales were 184,000 units, up 7.5 percent from the same period last year, and truck sales stood at 1.71 million units, a 9.3 percent growth year-on-year.

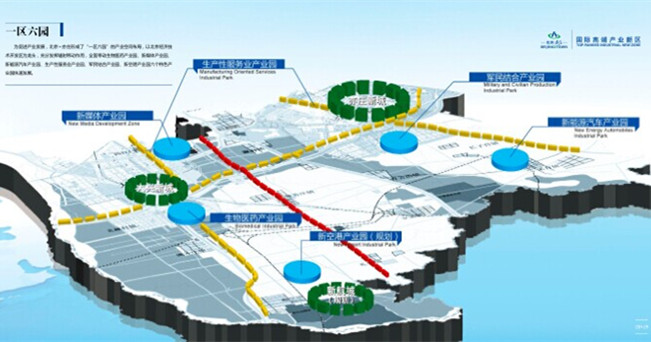

The Area with Six Parks

The Area with Six Parks Global Top 500

Global Top 500