BAIC African rally gathers speed

( China Daily )

Auto behemoth deepens overseas expansion with new plant in Port Elizabeth

There was a time when China's State-owned automobile enterprises such as Beijing Automotive Industry Corp found revenue rolling in easily from sales of vehicles made by their joint ventures with foreign companies to government departments. But, as their ambitions grew and the domestic market matured, they sought greener pastures overseas.

In line with that trend, BAIC, one of the five largest automobile manufacturers in China in terms of sales volume, has set up a manufacturing facility in South Africa. Its annual production capacity will be 50,000 vehicles by the end of 2019.

Located in Port Elizabeth, a shipping hub in South Africa, the plant is a joint venture between BAIC and South Africa's state-owned Industrial Development Corp, a financial company providing capital support for the country's companies and investment projects.

With a planned total investment of $800 million, the facility will start initial operations in the fourth quarter of this year.

Xu Heyi, BAIC's chairman, said the plant's first phase has generated 1,540 jobs already, with 90 percent of them filled by South Africans. The factory is expected to create another 2,500 jobs in the upstream and over 15,000 direct and indirect jobs in the downstream upon final completion late next year.

BAIC aims to supply automobiles, including passenger vehicles, SUVs, pickups and light trucks from this manufacturing facility not only to the South African market but the whole of Africa in the long run. Its focus will be on fast-growing markets such as Nigeria, Cameroon, Egypt and Algeria.

Equipped with an automated production line, the plant will offer both right-hand-drive and left-hand-drive vehicles for different African markets.

Xu said continued investment in infrastructure development will be the key to the group's sustained growth in Africa over the next decade as consumers there are keen to buy easily serviceable and inexpensive vehicles.

The factory, located in the Coega Special Economic Zone, was launched in August 2016. It is scheduled to have the capacity to assemble, paint and weld by the end of next year, while up to 60 percent of vehicle parts and materials will be sourced from South African suppliers.

Li Jingang, general manager of BAIC International Development Co, the special purpose vehicle implementing the project, said the company is geared to overcome local challenges.

For example, as in many African countries, new cars are beyond the reach of most people in South Africa. Used vehicles command a large share of the market. In most sub-Saharan African countries such as South Africa, Ghana, Ethiopia, Angola and Kenya, used cars account for 70 percent of overall vehicle sales.

The disadvantage in such markets is the brand life of some cars can be as long as 20 years, and anyone with one of the old models can face problems in obtaining spare parts.

For instance, Japanese carmakers including Toyota Motor Corp and Nissan Motor Co, the main source for preowned vehicles in Africa, have stopped producing spare parts for some models from the 1990s.

"Consumer trends in many African countries indicate that buyers go for vehicles for which spare parts are available in the nearest town," said Li. "Besides, we also found that more African consumers have stopped purchasing secondhand vehicles and began to buy new ones, as their incomes grew and various auto loans were offered by banks and dealers."

He said this certainly is a new growth market, because BAIC will be able to provide spare parts in sufficient quantities and after-sales services in time through dealerships and locally built warehouses. For the purpose, BAIC is using its industrial chain model in South Africa.

The number of dealerships of BAIC in South Africa will rise from the current 17 to 27 by the end of this year, he said.

The Beijing-headquartered BAIC employs over 130,000 staff worldwide and has built over 20 plants, research and development centers in Mexico, India, Japan, the Netherlands, Spain, Germany, Italy and the United States.

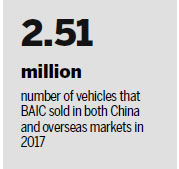

It sold 2.51 million vehicles in both China and overseas markets in 2017 to net 470.3 billion yuan ($68.85 billion) in revenue.

The group plans to sell 300,000 vehicles by 2020 in overseas markets through its sales networks in over 80 countries and regions.

Like BAIC, Chinese automakers including Shanghai-headquartered SAIC Motor Corp, Chongqing Lifan Group Co and Great Wall Motors Group Co have been boosting their sales overseas, and exported 891,000 vehicles in 2017, up 26 percent year-on-year, according to the China Association of Automobile Manufacturers, a Beijing-based industry body.

Auto exports last year included 639,000 passenger cars and 252,000 commercial vehicles.

"Because most of these export destinations have relatively undeveloped auto industries, the local governments welcome Chinese automakers that can bring in advanced technologies and impart relevant skills to workers," said Xue Rongjiu, deputy director of the China Society for World Trade Organization Studies, a Beijing-based think tank.

Since the auto market is seen as a barometer of the larger economy, countries accord priority to the industry as it reflects the scale of GDP, consumption power, regional trade and the scale of industrialization and infrastructure development, he said.

zhongnan@chinadaily.com.cn

|

A potential Kenyan buyer takes driver's seat to test-drive BAIC's new truck model under the guidance of a Chinese salesperson in Nairobi, Kenya. Provided to China Daily |

|

BAIC engineers inspect display cars bound for an auto exhibition during a dispatch ceremony at the company's new plant in Port Elizabeth, South Africa. Provided to China Daily |

(China Daily 08/13/2018 page14)

The Area with Six Parks

The Area with Six Parks Global Top 500

Global Top 500