BAIC Bluepark stock price rebounds

( chinadaily.com.cn )

|

|

Logo of BAIC BJEV hangs at expo in Shanghai, Sept 20, 2018. [Photo/VCG] |

The share price of BAIC Bluepark New Energy Technology Co surged to its daily trading limit of 10 percent on Friday market opening, after its stock price slumped 36.88 percent on the firm's first public trading day.

The firm is State-backed Beijing Automotive Group's electric vehicle unit that had a backdoor listing on China's A-share market on Thursday.

According to Securities Daily, which cited public data, revenues of the BAIC's electric vehicle unit were 3.47 billion yuan in 2015, 9.37 billion yuan in 2016 and 7.38 billion yuan in 2017. Profits were -184 million yuan, 108 million yuan and 39.24 million yuan, respectively.

However, most of the profits came from government subsidies. From 2015 to 2017, the subsidies were 57.96 million yuan, 148 million yuan and 24.75 million yuan each year respectively.

The reasons behind the plunge in the firm's share price on Thursday included the stock market environment, low profit and tightened cash flow. All these factors impact the firm's valuation, and as subsidies are cut, the firm's valuation is also influenced, said Securities Daily citing an auto industry insider.

|

|

A BAIC BJEV's new energy vehicle displays at an expo in Zhengzhou, Henan province, April 6, 2018. [Photo/VCG] |

By lowering subsidies, Darwinian principles will select powerful industry players in the new energy vehicle industry, creating an investment opportunity, the industry insider added.

BAIC's electric vehicle unit Beijing Electric Vehicle Co, founded in 2009, was spun off from BAIC in 2014 before the latter company's listing on the Hong Kong stock market.

In 2016, the BJEV absorbed non-State-owned capital to implement mixed-ownership reform and obtained 3 billion yuan in financing. In 2017, the firm launched B-round financing to obtain 11.12 billion yuan.

On Aug 27, the firm owned its shell company Chengdu Qianfeng Electronics Co that was once public on China's A-share market, and changed its name to BAIC Bluepark New Energy Technology Co.

As of press time, the firm's stock price remained at a 10 percent surge to 10.45 yuan per share.

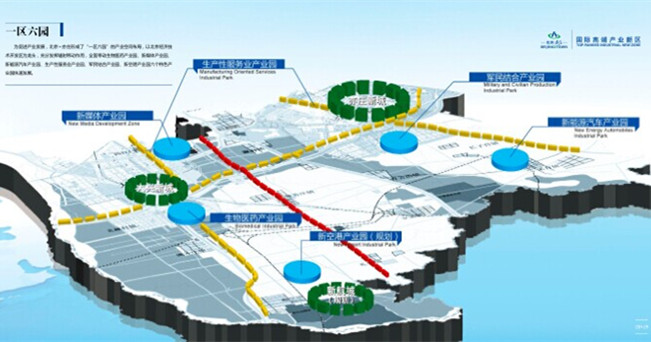

The Area with Six Parks

The Area with Six Parks Global Top 500

Global Top 500