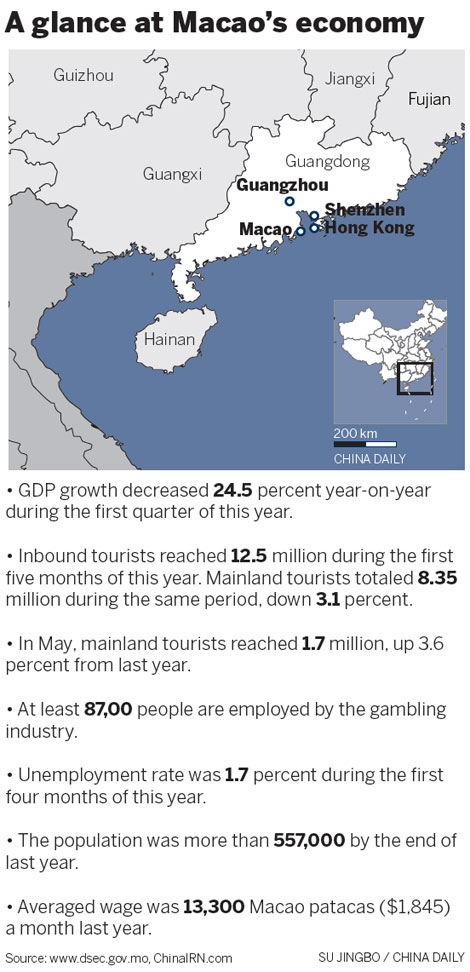

Macao spins the wheel to drive tourism sector

As the sector makes up about 80 percent of Macao's GDP, creating a new income stream has become a priority.

Already there have been warning signs about the depth of the slowdown. GDP on the island dropped by 24.5 percent in the first quarter compared with the same period last year because of falling revenue from casinos.

"Macao faces a restructuring period," Chui Sai-on, chief executive of the Macao Special Administrative Reg-ion, wrote in his annual work report. "Macao should develop into a tourism and leisure center to offset the falling gaming sector (revenue)."

In December 2014, President Xi Jinping urged the island to "nurture new growth areas" during a visit to Macao. To do this, the island must attract more traditional tourists.

Resort operators are trying to do just that. GEG is targeting the mainland market as well as visitors from South Korea, Japan and countries in Southeast Asia.

Walking through the Galaxy Macao complex, you can reach luxury hotels that line the resort. There is the Ritz-Carlton "first all-suite" hotel along with Asia's largest JW Marriott. Next door are the Banyan Tree Macao, Hotel Okura Macao and Galaxy Hotel, providing about 4,000 rooms all together.

At 574 meters, the Skytop Adventure Rapids at JW Marriott is the world's longest water run and was built to entice families and a new generation of tourists.

Other resorts are also looking to expand their reach. Next to the Galaxy Macao is the Studio City Macao, owned by Melco Crown Entertainment Ltd.

Melco expects to complete the tallest Ferris wheel in Asia by the end of this year to attract young families. Sands China Ltd is building a $1.7 billion resort, which will feature a half-size replica of the Eiffel Tower.

"We have suffered a pretty tough period over the past year," Lui, of GEG, said.

"The market environment now is quite different from a year ago, which made us consider diversifying the business."

With 65 percent of the island's visitors coming from the mainland, Macao's gaming industry suffered during the government's anti-corruption campaign.

The number of VIP gamblers, who are prepared to wager at least HK$1 million, fell dramatically. VIP gamblers contribute more than two-thirds of the total gaming revenue in Macao.

"The headwind from the anti-corruption (campaign) influenced all the casinos in Macao, especially the GEG and SJM Holdings Ltd, as they have more than 50 percent of the VIP gambling market," said David Green, founder of Newpage Consulting, which specializes in gaming research.

While the VIP business slowed, the mass market sector increased last year. Statistics from Macao Government Tourist Office reported that more than 31.5 million tourists visited the island in 2014, with 21 million coming from the mainland.

Hopefully, that trend will continue now that the entry permit policy for mainland passport holders has been changed to allow local tourists to stay up to a week instead of five days, according to a Xinhua report.

"The visa relaxation decision should help improve sentiment in the sector," DS Kim, an analyst at JP Morgan Chase & Co, said in a note reported by Bloomberg.

Still, resort companies such as GEG are expanding their interests just outside Macao. Ye Yanmin, senior vice-president of the group, said the entertainment company was working on a resort project at Hengqin Island without disclosing how much it would cost.

A special economic zone in Zhuhai, Guangdong province, Hengqin has a connecting bridge to Macao, which was opened in 2009.

"The project will focus on leisure and entertainment, such as a golf course and a resort. We are confident about this development, as the economic zone of the Pearl River Delta will be a big and broad market," Ye said.

"Convenient transportation will connect Macao with Hong Kong, Zhuhai and Guangzhou to provide more business opportunities."