Focus

Putting great store in ties

By Xin Zhiming and Qin Jize in Beijing and Zhang Haizhou and Zhang Chunyan in London (China Daily)

Updated: 2010-11-10 07:51

|

Large Medium Small |

Words of warning

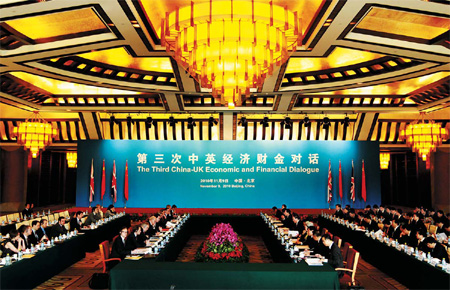

Outside of the Great Hall of People in Tian'anmen Square, the flags of China and Britain flew side by side - and it is in this fashion that the two nations have vowed to push global economic recovery.

"The priority (for the world) is to enhance macroeconomic policy coordination, oppose all types of protectionism and avoid economic issues from being politicized to benefit all-round recovery of the world economy," said Vice-premier Wang Qishan.

However, experts warn the recovery could be jeopardized by the quantitative easing policy of the US as it may push up inflation in the developing countries and cause chaos in the financial markets.

"The large amounts of capital into the emerging market economies will lead to rising inflationary risks," said Wang during the China-UK dialogue.

The US Federal Reserve has released its latest quantitative easing policy by buying $600 billion in government bonds to keep borrowing costs near zero and prop up the ailing economy. A number of countries have expressed concern about the expected liquidity boom.

China and Europe may discuss the impact of the quantitative easing at the G20 summit in Seoul.

Capital inflows into developing countries have been increasing rapidly, reaching $46.4 billion by the end of October, compared to a total of $9.4 billion in 2009, according to EPFR, the global fund tracker.

Thailand has imposed a 15-percent withholding tax on interest and capital gains earned by foreign investors on Thai bonds, while South Korea has asked banks not to lend in foreign currencies.

China's foreign exchange regulators also vowed on Tuesday to take new measures to control abnormal cross-border capital flows.

The State Administration of Foreign Exchange (SAFE) said it will force banks to hold more foreign exchanges and strengthen auditing of overseas fundraising as part of its efforts to clamp down on inflows of "hot money", or speculative capital.

The foreign exchange regulator said in a statement that it will tighten management of banks' foreign-debt quotas and introduce new rules on currency provisioning. The government will also regulate Chinese special-purpose vehicles overseas and tighten controls on equity investments by foreign companies in China.

"Some international funds will flee from dollar assets because of the (US) Fed's easing, and China's SAFE is trying all means to plug loopholes in possible channels for hot-money inflows," said Zhao Qingming, a senior financial analyst at China Construction Bank in Beijing, the country's second-largest lender.

The statement also said that a bank's daily net dollar positions, in expired forward contracts and spot greenback holdings, should never be less than the previous day's levels. Forcing banks to keep hold of the US currency will limit their ability to meet orders for yuan purchases, say analysts.

"This is to ask banks to hold more foreign currency to help ease pressure on the growing size of China's foreign exchange reserves," Zhao said. "To some extent, it can help limit yuan gains in the short term."

China's foreign exchange reserves reached $2.65 trillion by the end of September. The yuan, meanwhile, has risen continually since mid-June, further stoking the fire for capital inflows.

China called for responsible policies from the developed economies.

"The world economies should take responsible fiscal and monetary policies (to help global economic recovery)," said Li Dongrong, assistant governor of the People's Bank of China, the central bank.

China and the UK both agreed at the dialogue that the G20 should be the premier forum for international economic cooperation and major international institutions, such as the International Monetary Fund, should continue its reform process.

"Both sides agree that the heads and senior management of the international financial institutions should be appointed on merit, with no regards for nationality and that (their) staffing should be diversified," read a statement issued after the meeting.

Ai Yang in Beijing, Bloomberg and Reuters contributed to this story.