Ann Lee: Focuses on China-US economic relations

Updated: 2014-05-02 10:23

By Zhang Fan in New York (China Daily USA)

|

||||||||

The US financial community is closely watching China's shadow-banking system, concerned whether it will cause China's financial system to collapse, said Ann Lee, a leading expert on China and US economic relations.

"I spent a lot of time trying to figure out how large China's shadow-banking system is, in terms of whether China can basically avoid the vulnerability caused by such a system, and I am more inclined to say that it is not as serious as what happened here in the US," said Lee, a leading expert on China and US economic relations..

"If China's shadow-banking system causes crisis of confidence in China's financial system, the authority have enough tools in their monitoring tool box to correct those things," Lee said, adding that it is a "delicate" issue that the government should "really be careful on".

Lee, a Chinese American economic expert born in Hong Kong, is dedicated to the research of China-US economic relations, international finance and trade, and China's political economy. She is a senior fellow at Demos, a US-based think tank, and also an adjunct professor at the New York University.

In her most well-known book, What the US Can Learn From China (2012), Lee wrote about what the US can learn from China's competition, especially China's experience in boosting its economic growth and avoiding the influence of the global economic meltdown.

Various economic experts and former US government officials praised the book, including Charlie Kolb, president of the Committee for Economic Development and a former deputy undersecretary of the US Education Department.

Kolb said Lee's book shows how the US can learn much from the country that "will soon have the world's largest economy", and people should "all listen to her now as she describes how China and the United States can work together to shape a safer and more prosperous world".

"I wrote the book because I felt that Western perceptions of China in general were too lop-sided, decidedly negative, and primarily superficial," said Lee, "I had hoped to offer a modest counterweight to the overwhelming anti-China bias in the press and in Washington."

She said the biggest challenge during her writing came from the publisher, who asked to limit the final manuscript to 250 pages.

"I'm blessed that the book has caught attention from around the world. I've already been invited to speak in over a dozen countries. I hope it has had some effect in raising public discourse to a higher level," she added.

Lee said despite China and the US being very different, there are also many similarities, and "there are certain elements that are true for all societies".

"Learning can be a two-way street. They have learned plenty from us, and we can learn from them. If we can find a way to put aside our prejudice and take the best from the West and integrate it with the best from the East, perhaps we can advance civilization and create a better world for all," Lee said.

According to Lee, there are many problems that China and the US can cooperate on to achieve a better world, such as environmental damage, pollution and climate change. All those issues are "clearly important to both nations and neither one can do it alone," she said

She especially stressed the technical exchange between China and the US, such as in the clean-energy industry, high-speed trains and clean infrastructure, which she called "potentially low hanging fruit"

"In all of these areas, if they can come up to what they like to export to each other and import, and figure out a sequence of what deals happen first and last, that could be a great grand bargain that could help each other over trade," said Lee, "that also can not only generate jobs but also clean the environment, which would be big wins."

A recent report published by the Rhodium Group shows that Chinese foreign direct investment in the US reached $14billion in 2013, with the average size of projects increasing, double the amount of the previous year.

Among all the sectors, the food industry became a major recipient of Chinese capital, absorbing almost $7.1billion. Commercial real estate also became a hot sector with $3.2 billion in about 18 projects.

Such investment, however, aroused suspicion of the US public. A 2013 Hill+Knowlton strategies survey shows that more than half of Americans surveyed believe China poses the greatest threat and about 34 percent were "not comfortable" with any investment from Chinese firms.

Lee said overall Chinese investment in the US is a good trend since it "will create more job opportunities for Americans" especially when the US economy is still recovering, though she said it is a complicated problem involving a lot of issues.

"Americans used to worry about the Japanese. Now the Japanese invest a lot in car manufacturing here and hired a lot American workers, so they no longer have a problem with that," Lee said. "I think it just takes a matter of time and adjustment for Americans to get used to that idea and to understand that maybe their Chinese managers are just as nice to work for and not a threat."

Chinese Premier Li Keqiang said in 2013 that China needed to enlarge its domestic market to achieve economic transformation. In a newly released report by China's Customs, the country's import and export volume in the first quarter of 2014 decreased 1.2 percent and 6.1 percent, respectively.

Lee said China's enlarging domestic market should help economic relations between China and the US because the enlarged Chinese middle class means a large market for the US.

"The whole world is looking at China to grow its domestic economy, so that they can benefit through the cooperation," Lee said. "Frankly, China's export market in Europe and the US has shrunk because of economic-growth issues, so china cannot follow that model anyway."

Lee said no one, including her, is able to predict whether Chinese economic growth will continue. The Chinese government should watch the factors involved much more carefully so they could avoid certain bubbles.

"Just because you have a continuous growth in the past, it does not necessarily mean the future is going to grow all over the same. What I have always said is that nobody has a crystal ball on this. All you can do is make decisions with the best information available," she said.

Sino-US doctors join hands to fix young hearts

Sino-US doctors join hands to fix young hearts

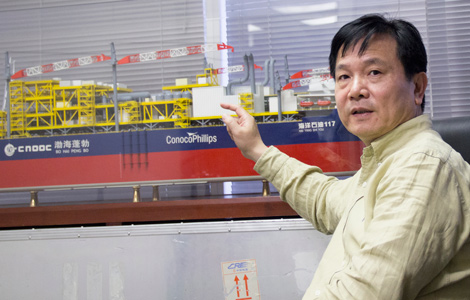

CSSC to expand its offshore businesses

CSSC to expand its offshore businesses

Lenovo CEO honored with Edison innovation award

Lenovo CEO honored with Edison innovation award

Shopping spree

Shopping spree

Top 10 world's highest-paid athletes

Top 10 world's highest-paid athletes

NY real estate firms woo Chinese buyers

NY real estate firms woo Chinese buyers

China 'to lead' digital revolution

China 'to lead' digital revolution

Miss CA: Key to success is to 'keep trying'

Miss CA: Key to success is to 'keep trying'

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China's manufacturing picks up in April

Chinese firms join IBM's new chip-tech group alliance

Xbox One may see buying rush in China

China's Xi orders 'crushing blow' to terrorism

Malaysia releases preliminary report on MH370

China, Russia to hold joint military exercise in May

Chinese, Australian PMs discuss MH370 flight

China, Russia to hold joint military exercise in May

US Weekly

|

|