Alibaba names ex-Treasury official as communications chief

Updated: 2014-05-13 06:25

By MICHAEL BARRIS in New York (China Daily USA)

|

||||||||

Alibaba Group Holding Ltd's hiring of a former US Treasury secretary's former chief of staff to build the e-commerce giant's international corporate affairs team reflects its aim to "have the right people in place" as it readies for its US initial public offering, cofounder and executive chairman Jack Ma said.

It's important to have staff members with "a track record of building bridges across geographic boundaries", Ma commented in a statement on the appointment of Jim Wilkinson as head of international corporate affairs. "Jim's leadership, global experience and successful track record will help Alibaba bring the message of our mission to markets outside China: to make it easy to do business anywhere," Ma was quoted.

Wilkinson will be based in the San Francisco area. He will helm the company's effort to maintain good media and US government relations before Alibaba goes public later this year on an as-yet unidentified New York stock exchange. Alibaba officially filed for the long-anticipated IPO last week.

Before serving as former Treasury Secretary Henry Paulson's chief of staff from 2006 to 2009, Wilkinson was senior adviser to former US Secretary of State Condoleezza Rice between 2004 and 2006. He became executive vice-president of communications of beverage and snacks giant PepsiCo in 2012. Wilkinson takes over the post from fellow American John Spelich, who moved to Alibaba's international e-commerce department as a vice-president in February.

"Jim is a proven team builder and leader in global corporate affairs with a strong track record of integrity, passion and commitment that reflect the Alibaba values," Alibaba vice-chairman Joseph Tsai was quoted on the New York Times' website.

Alibaba is looking to sell about a 12 percent stake, valuing the planned offering at about $20 billion, topping Facebook's $16 billion IPO last year, Bloomberg News reported. After the IPO, Alibaba would rank 34 the globally by market value, behind China Construction Bank Corp and French energy company Total SA, according to Bloomberg.

Alibaba's market value is estimated at $168 billion, bigger than 95 percent of companies in the Standard & Poor's 500 Index. It would be the most valuable Internet company after Google Inc., according to Bloomberg-compiled data.

Often described as a combination of EBay and Amazon, Alibaba handled $240 billion of merchandise in 2013. With more than 7 million merchants, it has more than $2 billion in revenue and profit of more than $1 billion.

The e-commerce company provides various marketplaces for buyers and sellers, as well as services that help them conduct their businesses. Taobao Marketplace, founded in 2003, enables millions of individuals and small businesses to sell products. Tmall.com operates as a virtual shopping mall, with retailers and brands offering products. Alibaba's other businesses include Juhuasuan, a discount web.

The company's pending IPO has helped spur a flurry of US IPO filings by Chinese technology companies. Last week, Internet security application developer Cheetah Mobile and online tour-booking website Tuniu both went public in New York, coming on the heels of micro blogging service Weibo Corp's offering.

For this reason, some analysts predict that the US market for cross-border listings by Chinese companies will cool after Alibaba's IPO.

PLA Honor Guard debuts female members

PLA Honor Guard debuts female members

Villager retraces begging journey to pay off debts

Villager retraces begging journey to pay off debts

Confucius Inst launches Latin American hub

Confucius Inst launches Latin American hub

Forum trends: You know you are in China when…(Part II)

Forum trends: You know you are in China when…(Part II)

More than 10,000 dancers will parade in NYC

More than 10,000 dancers will parade in NYC

Experts: Currency no big deal

Experts: Currency no big deal

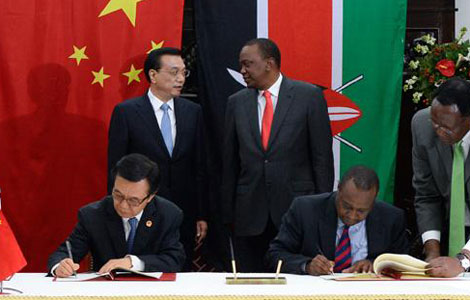

Chinese cut big African air deal

Chinese cut big African air deal

Across America

Across America

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trip reflects militaries' will to seek closer ties

Russia says respecting choice of Donetsk, Lugansk

People in eastern Ukraine declare independence

Man detained for posting rumors on foreign website

Turkmen relations get horsepower

Legal strides made to end police torture

Chinese-teaching majors face bleak job prospects

China aids in cutting down space debris

US Weekly

|

|