Money

Banks and drugmakers boost the markets

Updated: 2011-05-06 12:58

By Irene Shen (China Daily)

|

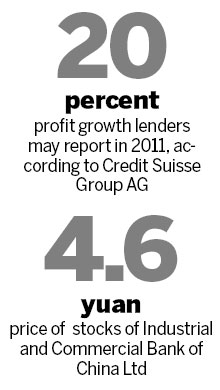

The staff engaged in a discussion at the Industrial and Commercial Bank of China Ltd in Nantong, Jiangsu province. The bank gained 1.55 percent after Credit Suisse Group AG said the lender may report profit growth of 20 percent this year. [Photo/ China Daily] |

The advance came on speculation that the earnings of drugmakers and producers of consumer staples will be sheltered from slowing economic growth.

Industrial and Commercial Bank of China Ltd (ICBC) and China Construction Bank Corp gained more than 1 percent after Credit Suisse Group AG said lenders may report profit growth of 20 percent this year. Jointown Pharmaceutical Group Co rose the most in three months on prospects the government will boost development of the drug-distribution industry. Jiangxi Copper Co, the biggest copper producer, fell to a seven-month low.

The Shanghai Composite Index, which tracks the bigger of China's stock exchanges, added 0.2 percent, to 2872.40 at the 3 pm close.

The nation's economic growth can exceed 9 percent this year although it faces uncertainties including the risk of over-tightening, Yu Yongding, a former academic adviser to the People's Bank of China said on Thursday.

Inflationary pressure "remains high but is controllable this year", and there is no need to be "overly worried" about price increases, Yu said. While it will be difficult for the government to keep inflation below its 4 percent target this year, limiting the growth in consumer prices to under 5 percent is "achievable," he said.

Credit Suisse (CS) said banks will boost profit in 2011 after they signaled "continued strength" in fee income and net interest margins in the first quarter. The brokerage remains "constructive" on large banks, with ICBC, China Construction Bank and Agricultural Bank of China Ltd making up its top picks, analysts wrote in a report on Thursday.

ICBC jumped 1.55 percent to 4.60 yuan (71 cents), its biggest gain since April 6. China Construction Bank, the second-largest lender, advanced 1.4 percent to 5.19 yuan.

Bank shares in China and so-called consumption stocks are among those that may rebound in the third quarter, said Anthony Cragg, a portfolio manager at Wells Capital Management, without naming any companies.

"Those countries who got onto the inflation problem earlier and more proactively and aggressively will come out of it earlier and I would put China in that category," said Cragg.

China's central bank has lifted borrowing costs four times since October to cool prices that grew at the fastest pace since 2008 in March. It has ordered lenders to set aside reserves 10 times since the start of last year to curb lending.

A gauge tracking health-care companies in the CSI 300 gained 1.4 percent, the second-most among 10 industry groups. The measure tracking consumer staples rose 1.3 percent.

Bloomberg News

Specials

Bin Laden dead

The world's most wanted man was killed in a US raid in Pakistan.

British Royal Wedding

Prince William and Kate Middleton married at Westminster Abbey in a royal occasion of dazzling pomp and pageantry.

Best wishes

The final frontier

Xinjiang is a mysterious land of extremes that never falls to fascinate.