Economy

Time running out for third-party payment firms

Updated: 2011-08-24 10:11

By Shi Jing (China Daily)

|

|

|

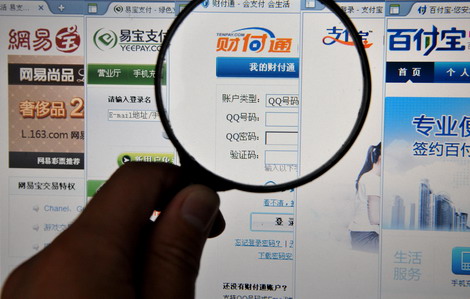

A netizen browses third-party payment websites in Taizhou, Zhejiang province. The People's Bank of China will decide whether 131 companies will be awarded licenses allowing them to operate. [Photo / China Daily] |

According to the "non-financial institution payment service administrative measures" issued by the central bank on Sept 1, 2010, third-party payment companies should apply for and receive the payment business license within one year of the measures taking effect, which is Sept 1 this year. Those who fail to obtain the license by the correct date will be disqualified from continuing with the payment business.

A total of 27 Chinese third-party payment companies received their licenses on May 26, including Alipay, the affiliated third-party online payment platform for the e-commerce giant Alibaba Group, and Unionpay Merchant Services Co, an affiliated payment institution of China UnionPay Co Ltd. But 131 companies are still awaiting approval from the central bank.

"What is special about these 131 companies is that most of them are operating in the prepaid card business, while the first 27 to have received the payment business license are mostly conducting online third-party payment business," said Zhang Meng, an analyst from the Beijing-based research company Analysys International.

Shanghai-based SandPay E-commerce Service Co Ltd received its payment-business license in May. However, in July it announced on its official website that it had suspended all issuance of new cards.

"The license we have obtained specifies that we can only carry out payment business. With regard to card issuance, we are applying for another license. Therefore, we have suspended the issuing of new cards for the time being. But it is not known when we will offer new cards again," said a source at SandPay who declined to give his name. "But consumers can rest assured that all our cards will function normally even after the central bank's deadline. The bank has ruled that related companies will be disqualified from conducting payment business. But it has not said that consumers will be unable to use the cards after the specified date," he said.

As a leading prepaid card company in Shanghai, Bailian E-commerce Co Ltd has been issuing the popular Lianhua OK card for several years, which can be used in more than 9,000 commercial outlets, with the total face value amounting to some 900 million yuan ($140 million), as the Oriental Morning Post reported on Monday.

Although Bailian has not yet received a payment service license, according to the Shanghai Youth Daily newspaper, the company has invested 100 million yuan and has registered a company to conduct its third-party payment business with the State Administration for Industry and Commerce.

The PBOC says that consumption at stores belonging to the companies that issue prepaid cards does not constitute third-party payment. As Bailian covers a large number of stores in the Shanghai area, consumption has been little affected.

But the third-party payment companies still have to face the deadline. "There are two possibilities. One is that the central bank will issue the licenses for these 131 companies before Sept 1. The other is that the specified date will be adjusted, which is more likely to happen given the timescale," said Zhang of Analysys International.

Specials

Biden Visits China

US Vice-President Joe Biden visits China August 17-22.

Star journalist leaves legacy

Li Xing, China Daily's assistant editor-in-chief and veteran columnist, died of a cerebral hemorrhage on Aug 7 in Washington DC, US.

Hot pots

Tea-making treasures catch the fancy of connoisseurs as record prices brew up interest