Volatility to dominate economy

Updated: 2012-02-28 08:08

By He Wei (China Daily)

|

||||||||

|

The global economy is shadowed by enormous uncertainty, according to Alexander Friedman, chief investment officer of UBS Wealth Management. [Gao Yuwen / for China Daily] |

But China on track for 'soft' landing, aided by falling inflation and monetary easing

SHANGHAI - In a world in which everyone is trying to shed debt, global investors should retain a preference for the US dollar, buy more bonds than equities and not worship gold as a safe haven.

That is the asset allocation suggestion for this year from Alexander Friedman, chief investment officer of UBS Wealth Management.

"As the global economy remains fragile, volatility will remain and credits will likely outperform equities over the medium term. A diversified investment strategy is key to more stabilized earnings," Friedman said.

According to Friedman, the deleveraging process gripping the developed world will likely continue for a number of years and remain a drag on growth. "Therefore in 2012 and beyond, yield is increasingly important."

Because the global economy is shadowed by enormous uncertainty, Friedman said the negative side of long-term secular trends, changing demographics, information velocity and developed/emerging growth disparities are exacerbated.

"Special events happen much more frequently and politics will play a destabilizing rather than stabilizing role," he said, referring to the political uprisings across North Africa and the Middle East that led to a spike in oil prices.

Dan Steinbock, research director of International Business at the India, China and America Institute, echoed the view on how politics has led to unrealistic assumptions about many current issues. The initial decision to grant Greece membership in the eurozone, he said, was motivated by political considerations, not economics.

As a result, Greece has been forced to adopt austerity measures, causing suffering that could have been avoided. The risk of contagion in the eurozone also emerged, Steinbock said in an e-mail to China Daily.

He said the outlook for the eurozone remained gloomy, with loaning, liquidity and solvency problems.

In addition, the United States debt ceiling debate led the rating agency Standard & Poor's to do the "unthinkable" and downgrade the US' gross domestic product rating, causing the S&P 500 to plummet by 6.6 percent the following day, according to Friedman. "That demonstrates how fragile the concept of "risk-free assets" is in a deleveraging world."

Entering 2012, continued political uncertainty, including the ongoing tensions between Iran and the West, among other geopolitical disputes, is likely to increase market volatility.

Most investors had believed that safe havens included gold and the Swiss franc. But the Swiss National Bank's intervention effectively removed the franc from the list, Friedman said.

And, although gold does not have a central bank trying to depreciate its value, it dropped some 8 percent intra-day on Sept 26, underscoring gold's possible volatility during severe, liquidity-driven market sell-offs.

Although European policy makers are busy mapping out a once-for-all bailout plan for the debt-ridden continent, Friedman said the strategy of waiting to see tangible evidence of political solutions to the European crisis, rather than being swept up in hopeful rallies, remains valid.

Recent months have been marked by equity markets rallying sharply into European summits on hopes of a resolution to the sovereign debt crisis, with the results proving disappointing and markets selling off by an even greater amount.

"Politicians have in effect become a destabilizing force in financial markets," said Friedman. "As a result, we start 2012 with an asset allocation that is underweight in European equities, and have a strong preference for US over European assets, including equities, corporate credit and currency."

In addition, Norway's krone remains attractive to investors looking to diversify their currency exposure into solid economies because of the country's abundant natural gas reserves.

The World Bank recently warned developing countries to prepare for the risk of a slump like the global downturn in 2008 and 2009, owing to an escalation in the eurozone debt crisis.

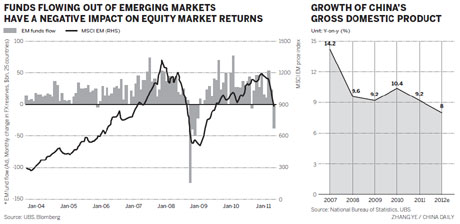

With investors seeking higher returns, more quantitative easing has driven "hot money" into high-yield emerging-market economies. Therefore developing countries have been compelled to move in the opposite direction: quantitative tightening.

Friedman held a positive view on China's economy, saying that the country remains on track to engineer a "soft" landing, aided by falling inflation and the first steps towards monetary easing.

He forecast Chinese GDP would grow about 8 percent in 2012, as robust domestic demand and stable investment offsets slowing exports. So "another attractive fixed income investment opportunity is Asian state-owned credits".

Recently, many research institutions have upgraded their forecast for China's major indicators in 2012.

With inflation dropping and growth slowing, China has gently but clearly changed macro policy direction from tightening to being somewhat supportive of growth. "Therefore, we forecast the GDP growth to reach 9 percent," said Zhou Hao, an economist with the Australia and New Zealand Banking Group Ltd

Wang Tao, chief economist with UBS China, adjusted the forecast for China's export growth from flat to 10 percent year-on-year in 2012, and 2012 GDP growth forecast from 8 percent to 8.5 percent.

"As exports stay resilient, we see less policy easing than the market expects and see at most one to two cuts in the required reserve ratio," she said.

China Daily

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|