Shares in Goldman Sachs lose $2.2 billion

Updated: 2012-03-16 07:38

(China Daily)

|

||||||||

|

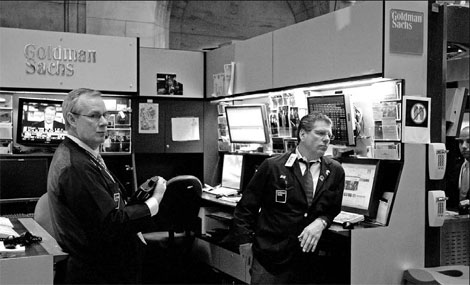

The Goldman Sachs Group Inc trading booth at the New York Stock Exchange. The bank's shares slid $4.17 to $120.37 on Wednesday. [Scott Eells / Bloomberg] |

Goldman Sachs Group Inc saw $2.15 billion of its market value wiped out after an employee assailed Chief Executive Officer Lloyd C. Blankfein's management and the company's treatment of clients, sparking debate across Wall Street.

The shares dropped 3.4 percent in New York trading on Wednesday, the third-biggest decline in the 81-company Standard & Poor's 500 Financials Index, after London-based Greg Smith made the accusations in a New York Times op-ed piece.

Smith, who also wrote that he was quitting after 12 years at the company, blamed Blankfein and President Gary D. Cohn for a "decline in the firm's moral fiber". They responded in a memo to current and former employees, saying that Smith's assertions don't reflect the company's values, culture or "how the vast majority of people at Goldman Sachs think about the firm and the work it does on behalf of our clients".

Former Federal Reserve chairman Paul Volcker, whose "Volcker rule" would limit banks such as New York-based Goldman Sachs from making bets with their own money, called Smith's article "a radical, strong" piece. "I'm afraid it's a business that leads to a lot of conflicts of interest," Volcker said at a conference in Washington sponsored by the Atlantic.

Goldman Sachs slid $4.17 to $120.37 on Wednesday. The shares are still up 33 percent this year.

David Wells, a spokesman for Goldman Sachs in New York, declined to comment beyond the contents of the memo and an earlier e-mailed statement in which the company said it disagrees with the views expressed in the op-ed.

Fraud lawsuit

Executives at Goldman Sachs haven't changed their behavior even after the company paid $550 million to settle a fraud lawsuit with the Securities and Exchange Commission and was accused by the US Senate's Permanent Subcommittee on Investigations of misleading clients, Smith wrote.

The company published a report in January 2011 with 39 recommendations on how to improve its business practices and client focus.

"Over the last 12 months I have seen five different managing directors refer to their own clients as 'muppets', sometimes over internal e-mail," Smith wrote. "It astounds me how little senior management gets a basic truth: If clients don't trust you they will eventually stop doing business with you."

The article was e-mailed across Wall Street. One employee at Bank of America Corp's Merrill Lynch division, a competitor to Goldman Sachs, said his team was told not to send copies to clients.

"It does hurt them," said Stephane Rambosson, managing partner at executive search firm Veni Partners in London and a former Citigroup Inc banker. "The perception of the firm has gone down, and a lot of the winners of tomorrow are sitting back and thinking: Do I want to be with Goldman?"

There's little evidence that the company's popularity with clients has been hurt by the SEC lawsuit, the Senate's criticism or a recent ruling by Delaware Chancery Court Judge Leo Strine, who faulted Goldman Sachs' handling of a conflict of interest. The bank won more business than any other in advising companies on takeovers and equity offerings last year, according to data compiled by Bloomberg.

Some clients of Goldman Sachs' sales and trading department, the business in which Smith worked, said they are always cautious in dealings with Wall Street banks, understanding that their interests can diverge.

Though some competitors relished the criticism of Goldman Sachs, which was the most profitable securities company in Wall Street history before it converted to a bank in 2008, they may not be so different.

Smith's opinion piece "seems to be symptomatic of many, if not most, of the banks around the world", said Tom Kirchmaier, a fellow in the financial-markets group at the London School of Economics. "It might be that Goldman, as one of the most successful ones, is also one of the most extreme."

Bloomberg News in New York

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|