Doubts emerge over subsidies sales boost

Updated: 2012-06-04 08:53

By He Wei in Shanghai (China Daily)

|

||||||||

Suning Appliance Co, the biggest home appliance retailer by market value, also gained 1.7 percent to 9.87 yuan, after its president Jin Ming said the policy will boost its sales.

"The new policy is likely to create 300 billion yuan in home appliances sales and is encouraging to retailers such as Suning," he said.

To answer the government's call, Jin said that, since January, 80 percent of Suning's procurement and sales of televisions and water heaters are rated level one or level two in terms of energy efficiency. Forty percent of air conditioners also meet that standard.

Moreover, 40 percent of Suning's sales in the last two years were under the home appliances replacement scheme, which prompted 70 billion yuan in sales.

According to Haitong Securities Co, the 26.5 billion yuan under the renewed policy equals a 12 percent subsidy on ex-works prices and an 8 percent rebate on the retail price.

The household appliance stimulus has boosted expectations that similar packages will follow to stimulate the economy and consumption, said Wu Kan, a Shanghai fund manager at Dazhong Insurance Co, which oversees $285 million. "The policy tone has shifted to maintaining economic growth."

Some believe the policy will have a limited effect on turning around the whole sector because people bought goods they anticipated they would need under the previous programs.

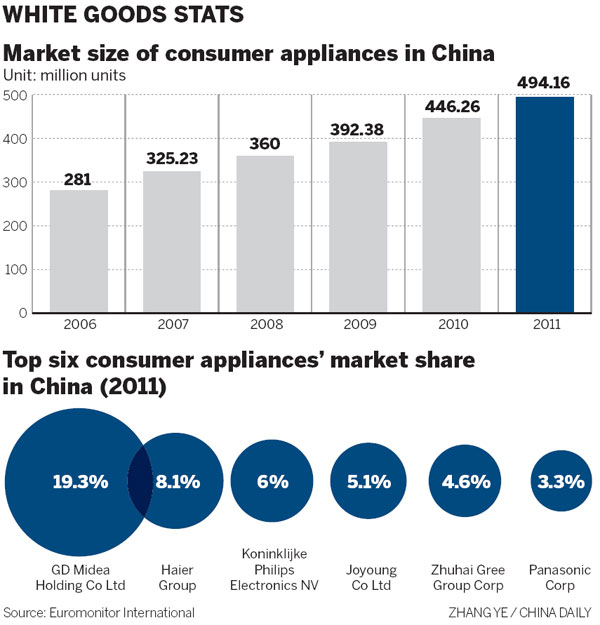

Spurred by the series of rebate policies, China's home appliance market rocketed to 494.2 million units in 2011, according to statistics from market research firm Euromonitor International.

Figures provided by Gome Electrical Appliances Holding Ltd show that the sales volumes of appliances under the home-appliance replacement scheme increased by more than 200 percent month-on-month in December.

"Sales of home appliances will still largely depend on the macroeconomic environment and property sales", Essence Securities wrote in a note in May. "Leading manufacturers are expected to benefit more from the new subsidy program."

Xie from Capital Securities Corp agreed. He believes refrigerators and washing machines lack the momentum for further growth because so many homes already have them or they are beyond the ability of some to buy them.

He predicts sales of air conditioners will increase most from the new policy because devices with new technology that helps lower waste gas emissions and is in accordance with the new policy that targets subsidizing energy-efficient products is now more prevalent.

"Based on our observations, the policy will subsidize constant-speed air conditioners that are rated level one in terms of energy saving, as well as level one and level two if they are inverter-aided. It will be stricter than a pilot program run in Beijing that rebated level two and above air conditioners, no matter what technology they apply," he said.

As market watchers warned the incentives may not necessarily drive up demand right away, salesmen expressed similar concerns.

"Not all washing machines will be included in the policy of giving subsidies to customers, even if they buy energy-efficient ones," said Zhao Yan, a veteran saleswoman at a Gome outlet in Shanghai.

Even if the policy has yet to be implemented, "to my knowledge, some foreign brands are not going to benefit from the program," she said, without revealing how she knew.

Zhao, 47, has been in the appliances sales industry for eight years. She was pessimistic about the scheme because the stagnant real estate market will fail to lift new demand.

"There is no need to buy new electrical appliances if people cannot afford new apartments. Besides, the whole economy is not as good as before," she said.

The policy of giving subsidies to customers doesn't seem to help to raise her sales figures.

"In the past few years, the situation was better. However, now fewer customers come to shop and today I didn't sell even one washing machine," said Zhao, whose monthly income is 1,450 yuan after pension payments.

The scheme has a limited effect in boosting sales for Japanese electronic appliance vendors, which suffered severe losses in the past year, said analysts.

Sony Corp flagged a record $6.4 billion annual net loss, double its earlier forecast and giving it a fourth straight year of red ink.

Similarly, consumer electronics and liquid crystal display screen maker Sharp Corp also increased its full-year net loss forecast to $4.7 billion from $3.6 billion.

Panasonic turned down interview requests on the upcoming policy. Calls to the public relations department of Hitachi went unanswered.

Japanese vendors only occupy a low single-digit percentage of China's white goods market. According to Euromonitor, Panasonic was the only Japanese company to be ranked among the top 10 vendors in 2011 with just a 3.3 percent market share.

For the air conditioner segment, Panasonic, Hitachi and Daikin each accounted for less than 1 percent of market share, Xie said.

Deng Jin contributed to this story.

hewei@chinadaily.com.cn

- Energy-saving streetlights light Xibuhe village, Lijiang city

- Air conditioner sales cool down

- China to float 30 billion yuan in e-savings bonds

- China to boost energy-efficient buildings

- China calls for more energy co-op with Europe

- Vice-Premier urges more energy co-op with Europe

- China seeks to expand green energy ties

- Energy use may be capped for 2015

- All want slice of China's new-energy car market

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|