Online video news 'bullish'

Updated: 2012-09-10 10:10

By Gao Yuan (China Daily)

|

||||||||

Outlook comes despite plunging value of shares

China's online news video market could be one of the few "blue oceans" left for Internet portals. The multi-billion yuan sector is expected to develop substantially over the next few years, said Li Ya, chief operating officer of Phoenix New Media Ltd, the country's fourth largest Web portal by audience viewing.

Li said that the company's advertising revenue, which has doubled annually during the last five years, will maintain strong growth this year. But, he refused to elaborate on the exact growth rate.

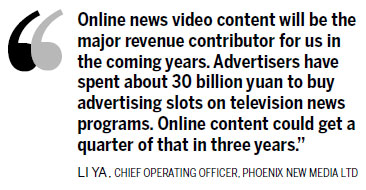

"Online news video content will be the major revenue contributor for us in the coming years. Advertisers have spent about 30 billion yuan to buy advertising slots on television news programs. Online content could get a quarter of that in three to five years," Li said, adding that online news video content is likely to lure roughly 7.5 billion yuan ($1.2 billion) in advertising earnings for the industry.

According to Li, online news content is not simply a replay of TV news programs: User-generated content will play a big role in future news websites.

He also predicted video advertising revenue would make up at least 25 percent of the company's total revenue. Currently, the sector accounts for about 15 percent of the company's advertisement revenue.

|

An anchor woman from v.ifeng.com broadcasting a story about the military. Online news video content will be the major revenue contributor for Phoenix New Media Ltd in the coming years, according to the company's chief operating officer, Li Ya. [Photo/China Daily] |

However, the number of advertisers declined by 3.4 percent compared with the previous quarter to 227.

"China's continuing macro-economic uncertainty resulted in the second quarter being more challenging than previously anticipated," said Liu Shuang, chief executive officer of Phoenix New Media. Some of the company's advertisers delayed advertising spending as their business growth slowed, he said.

The company's flagship website, ifeng.com, has seen a 62 percent year-on-year growth in daily unique visitors in the second quarter, reaching 26.4 million in June. Other major Chinese portals experienced single digit growth over the same period, according to iResearch Consulting Group, a Beijing-based Internet research company.

The rate of increase was the highest among all online video platforms, according to Li.

"That was because we are doing more jobs than traditional portals do. The website ifeng.com does not serve as an information hub, where an overwhelming amount of stories pile up," he said. "We are devoted to providing more exclusive news content and news stories with unique aspects."

The website will also beef up its editing team, Li said, without revealing a detailed plan.

In the last quarter, the company's average revenue per user, or total revenue divided by the number of subscribers, hit a record high of 650,000 yuan, an 18.5 percent increase compared with the first quarter of 2012. "The jump in ARPU indicates advertisers' increasing recognition of the value of the website," said iResearch.

However, Phoenix New Media's higher-than-expected business performance did not help to lift its stock price. Currently it is down more than 66 percent compared with its initial public offering price of $11.10. The Beijing-based company was listed on the New York Stock Exchange on May 12, 2011.

Late last month, Deutsche Bank downgraded the Chinese company's ratings to "hold" in fear of advertising cuts as China's economy slows. The nation's gross domestic product growth fell to a three-year low of 7.6 percent in the second quarter.

The nation's overseas-listed companies have accused short sellers on Wall Street of issuing false information about Chinese companies to drag down share prices.

In late July the company announced it may buy back up to $20 million of its outstanding American depository shares this year.

“The current stock price fails to reflect the company’s true value,” said Li. He also said the repurchase plan was only a short-term move.

“We are focused on daily business executions and strive to deliver solid financial results , which will convince investors about our long-term outlook and value, eventually,” he said.

gaoyuan@chinadaily.com.cn

- China to promote audio-video coding standard

- Youku, Tudou announce completion of merger

- China's online video portals asked to filter content

- China's online video users reach 325m

- Phoenix TV arm sees surge in online ad revenue

- Online media should stop privacy invasion

- Rich media modernising today's adverts

- BOC, Phoenix TV ink co-op deal

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|