Gloomy markets defy expected growth

Updated: 2012-12-17 09:49

By Chen Jia (China Daily)

|

||||||||

Indicators

"The central economic working conference, which opened on Saturday to set the policy stance for the next year, is expected to deliver a sign that the economic environment will remain sound in the coming years," he added.

The many positive economic indicators since the end of the third quarter will help stocks rebound, according to Li.

November industrial output grew 10.1 percent year-on-year, from 9.6 percent in October and 9.2 percent in September, reaching an eight-month high, the National Bureau of Statistics said on Dec 9.

In addition, the manufacturing Purchasing Managers' Index increased to 50.6 in November from 50.1 in October, the bureau said, showing that the expansion of the manufacturing industry is firming up.

The restarting of rail investment, continued development of infrastructure projects and signs of a recovery in global technology demands have all contributed to gains in fixed investment and industrial production over the past few months, which could confirm an uptick of the growth in the fourth quarter, according to a report from Moody's Analytics.

"Just know this - the performance of the domestic equity market is not so tightly correlated with the overall economy," said Wang Tao, chief China economist with UBS AG.

In the past few quarters, corporate earnings have declined sharply in line with the economic slowdown. The net income of big industrial business dropped to negative 1.8 percent in the first nine months according to the statistics bureau.

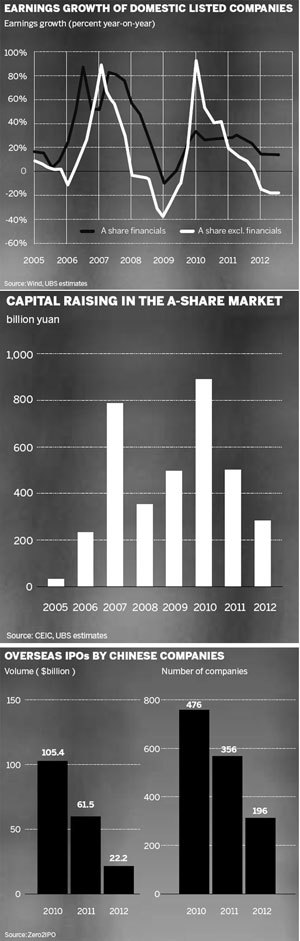

In the light of the gloomy business environment, Wang said the earnings growth of listed companies excluding financials in the A-share market first dropped sharply and then turned negative this year.

"There seems to have been a continued de-rating in the A-share market over the past three years, with the current price-earnings ratio lower than during the global financial crisis," Wang said.

In the first three quarters, all the 2,471 companies listed on the A-share market gained a net profit of 1.5 trillion yuan, lower than the 1.61 trillion yuan by or 2.07 percent from the same period last year, according to data from Wind Information.

The data also showed that about 86.8 percent of the A-share companies achieved net gains in the first nine months, less than the 91.26 percent in 2012.

Related Readings

China cracks down on false disclosures by listed firms

Nomura tips rebound for China stocks

Chinese 'Nasdaq' hopes fade away

Stock investors display double vision

A-share market to pick up in 2013, says Dai Xianglong

Relief reaches isolated village

Relief reaches isolated village

Rainfall poses new threats to quake-hit region

Rainfall poses new threats to quake-hit region

Funerals begin for Boston bombing victims

Funerals begin for Boston bombing victims

Quake takeaway from China's Air Force

Quake takeaway from China's Air Force

Obama celebrates young inventors at science fair

Obama celebrates young inventors at science fair

Earth Day marked around the world

Earth Day marked around the world

Volunteer team helping students find sense of normalcy

Volunteer team helping students find sense of normalcy

Ethnic groups quick to join rescue efforts

Ethnic groups quick to join rescue efforts

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Health new priority for quake zone

Xi meets US top military officer

Japan's boats driven out of Diaoyu

China mulls online shopping legislation

Bird flu death toll rises to 22

Putin appoints new ambassador to China

Japanese ships blocked from Diaoyu Islands

Inspired by Guan, more Chinese pick up golf

US Weekly

|

|