Ratings agency warns about rising debt

Updated: 2013-02-26 10:13

By Wei Tian (China Daily)

|

||||||||

|

A global credit war characterized by a surging money supply and currency depreciation, with undefined amounts and duration, will drag global credit into a currency crisis, Chinese ratings agency Dagong warned on Monday. [Photo / China Daily] |

Dagong says current pace of growth approaching 'unsustainable' levels

Rising levels of sovereign debt in developed countries are posing a series of threats to emerging economies, China's leading credit rating agency has warned.

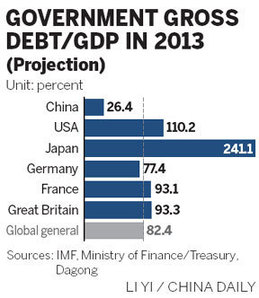

In a report published on Monday, Dagong Global Credit Rating said this year the government debt of some already "highly indebted" developed countries - which accounts for 80 percent of outstanding global government debt - will continue moving toward what it called an "unsustainable state".

It warned that it now expected an ongoing global credit war as a result, "characterized by surging money supply and currency depreciation", which would drag the global credit market into "a currency crisis".

The Beijing-based ratings agency - which announced in October that it was partnering with agencies in the US and Russia in a bid to break the dominance of major ratings names such as Moody's in assessing national and company debt - estimates that the debt of these countries will reach 331 percent of their fiscal revenue (against 328.4 percent in 2012), and 123.5 percent of their GDP (120.9 percent in 2012).

|

|

Its report said the accommodative monetary policy of the US Federal Reserve has relied on the dollar's role as an international reserve currency, transferring its debt risk to creditor countries.

In Japan, it added, sovereign credit risk is also on an upward trend, due to its inability to solve its underlying economic problems, with the government there resorting to an extreme loosening of its monetary policy to prop up a flat-lining economy.

Meanwhile, the report added that recessionary fears across the eurozone are unlikely to dissipate in 2013, meaning sovereign debt levels in various European countries will remain.

Dagong's comments came as Moody's Investors Service cut the sovereign credit rating for the United Kingdom on Friday from the highest Aaa to Aa1 - its latest in a series of downgrades of developed countries, since the US lost its triple-A rating in Aug 2011.

"The main driver of our decision to downgrade is that despite considerable structural economic strength, the UK's economic growth will remain sluggish over the next few years owing to the slow growth of the global economy," said Sarah Carlson, Moody's lead analyst on the UK.

The European Commission on Friday revised its 2013 GDP growth forecasts for the euro area and is now projecting a 0.3 percent contraction, rather than the 0.1 percent expansion it forecast just three months ago.

Moody's announced it was also credit-negative on all eurozone sovereign debt.

Dagong said it believed that measures to maintain high gross debt levels through continuously depressing interest rates and injecting liquidity cannot lead to a powerful expansion of a debt-ridden real economy.

"Debtors are extremely sensitive to interest rates and new credit risks will surface if rates continue to rise," it said.

Confronted with a credit war, emerging economies and low-income countries had again resorted to loosening monetary and fiscal policies, it added, in order to prevent a deterioration of their regional economies, which could also pose new challenges to sovereign credit risk.

It said that China, on the other hand, had consolidated its sovereign credit strength by gradually activating domestic demand to achieve sustainable growth.

The ratio of China's government debt as a percentage of its GDP reached a peak of 33.5 percent in 2010, and will gradually fall to 24 percent in 2014, according to Dagong estimates.

But Zong Liang, deputy head of the international finance research institute of the Bank of China, said China still needs to take active measures to deal with the quantitative easing policies of developed countries.

"We should preserve the continuity and stability of our monetary policy while still paying close attention to the inflow of hot money," he wrote in for Securities Daily.

Zong suggested that the government could lower the threshold of commodity imports to lower prices and guard against possible price hikes triggered by quantitative easing.

China should continue pushing forward the market-oriented exchange rate of RMB and allow more flexibility, to prevent global capital speculation, he added.

weitian@chinadaily.com.cn

- Dagong maintains China's AA+ credit rating

- France ratings cut 'unlikely to deter' Chinese investment

- Fitch reaffirms China's foreign currency rating at A+

- No 'silver bullet' over sovereign debt crisis

- China ready for bigger part in European debt solution

- S&P: China sovereign ratings affirmed at AA-/A-1+

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Venezuelan court rules out manual votes counting

Venezuelan court rules out manual votes counting

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Boston bombing suspect reported cornered on boat

7.0-magnitude quake hits Sichuan

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|