Brewing up the right recipe for success

Updated: 2013-03-21 07:33

By Wang Zhuoqiong and Xie Chuanjiao (China Daily)

|

||||||||

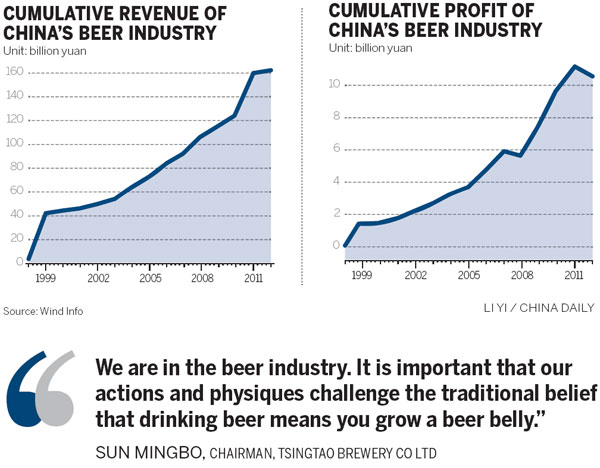

Domestic battlefield

For other businesses, going global involves expanding beyond their borders but for breweries China is the main battlefield, said Sun.

"It is not sensible giving up such a great market and competing in the saturated markets of developed countries," he said.

At work, Sun has two principles: "Never miss a major opportunity; never ignore a major threat." Failure regarding either of them would create trouble or even be fatal for the company, he said.

The sense of threat comes from a true and deep understanding of the Chinese market, Fang said, and an awareness of the large gap between local and foreign breweries.

After decades of expansion through many acquisitions, the Chinese beer industry is dominated by three domestic brands: China Resources Snow Brewery, Tsingtao Brewery and Yanjing Brewery, as well as three foreign brands - Anheuser-Busch InBev, SAB Miller and Carlsberg.

Anheuser-Busch InBev had a production volume of 5.59 million tons in 2011 and has plans to invest 20 billion yuan in building eight to 10 new manufacturing bases in China to achieve its goal of 15 million tons, Fang said. That's equivalent to more than 30 percent of sales in China.

On the domestic front, Tsingtao, although it is equipped with a strong mixture of local and national level brands and has 60 breweries in 19 locations, has strong rivals.

With 80 breweries and a 21 percent market share, the largest beer manufacturer by production volume is China Resources Snow Breweries. It is a peer of China Resources Enterprises Ltd and the world's second-largest brewery SAB Miller, and experienced sales growth of 5 percent in the first three quarters of 2012 of 9.06 million kiloliters.

The third-largest brewery, Yanjing Brewery, which is focused on a local strategy and has a 12 percent market share, grew 0.77 percent in the same period.

Sun said he believes the market could be further developed and competition lies in the capacity to execute new business models and raising operational efficiency.

"In the past, you only had to run fast. Now you have to run while making yourself really strong at the same time," he said.

Tsingtao's next move is to expand market share and raise sales volumes in central and western regions because the eastern market is saturated.

As for its global market, Tsingtao sells to more than 80 countries and regions and is expanding. Sun said its global presence is aimed at building a high-end brand with products that are among the most expensive.

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Venezuelan court rules out manual votes counting

Venezuelan court rules out manual votes counting

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Boston bombing suspect reported cornered on boat

7.0-magnitude quake hits Sichuan

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|