Sluggish growth takes its toll on foreign lenders

Updated: 2013-04-25 09:29

By Wang Xiaotian (China Daily)

|

||||||||

The capital adequacy ratio among foreign banks in China rose to 19.74 percent by the end of 2012, from 18.83 percent the previous year. Their core capital adequacy ratio stood at 19.25 percent, in contrast with 18.38 percent at the end of 2011.

"Overall the main indicators of foreign banks are all higher than the regulatory standards, and they are basically in a healthy condition," the CBRC said in the report.

By the end of last year, banks from 49 countries and regions had set up 42 locally incorporated banks, 95 branches, and 197 representative offices in China.

Outstanding loans extended by those banks increased 6.2 percent to 1.04 trillion yuan from one year earlier, while their deposits rose 7.7 percent to 1.43 trillion yuan.

- Foreign banks in Shanghai earn 12.5b yuan in profits

- Foreign banks see record profits in China

- Integration of foreign banks

- Foreign banks seek to bolster subsidiaries

- Foreign banks granted $24b of external debts

- Long-term debt quota increases for foreign banks

- Foreign banks remain optimistic over expansion in China

- Foreign banks' profits lag domestic results

- China suspends RMB loans from foreign banks

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

More Chinese travel overseas, study reveals

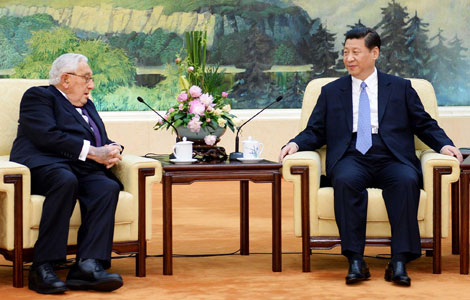

Xi meets former US heavyweights

Li in plea to quake rescuers

Canada to return illegal assets

Beijing vows to ease Korean tensions

Order restored after deadly terrorist ambush

Nation sets sights on bigger carrier

Hollande's visit expected to open new chapter

US Weekly

|

|