Price fall dims inflation

Updated: 2013-06-24 10:39

(bjreview.com.cn)

|

|||||||||

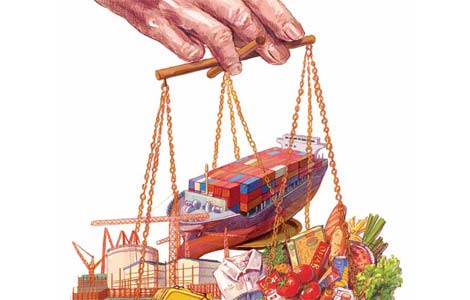

Hu believes the golden era for bulk commodities has now ended, with the reason being the market has changed from a seller's one to a buyer's one for many raw materials. Australia is a major supplier of iron ore to China, whose steel companies had to go through tough negotiations with Australian iron ore companies with few results. But this year, the situation has changed and the contracted sales volume of iron ore is falling.

Mediocre economic performance has curbed the prices and demand for bulk commodities in China and more drastic decreases are expected, says Hu. Among various commodities, the price fall of crude oil has wide-ranging significance. Since crude oil is an important "weathervane" in the market, its price fall will further pull down the prices of other commodities such as coking coal and steel billets, which have already been falling.

Xiang Songzuo, chief economist at the Agricultural Bank of China, says the central bank may face a predicament in formulating its monetary policy. The central bank may further relax its monetary policy to cope with commodity price falls with the aim of preventing an economic slowdown, but that may encourage speculative activities and steer the economy toward inflation.

Price drops of upstream products will increase the demand and facilitate recovery of the real economy, according to Xiang, thereby curbing the pressure of inflation. He hopes the central bank can maintain its present monetary policy and not make any adjustments simply because of the price drop in commodities.

Future tendency

Bulk commodity prices in the international market have been falling throughout the year, said Zhang Xiaoyu, a researcher with the Ministry of Commerce. By the end of May, Brent crude oil prices and Dubai crude oil prices had fallen by 10.8 percent and 8.3 percent respectively, and the price of Australia BJ steam coal had fallen by 7 percent; wheat and corn prices at the Chicago Mercantile Exchange fell by 7.6 percent and 4.9 percent respectively; six non-ferrous metals at the London Metal Exchange had gone down by 10-15 percent, while gold and silver prices at the New York Mercantile Exchange had fallen by 17.8 percent and 27.4 percent respectively.

The global economic crisis has made countries around the world reflect on their growth models. Developing manufacturing and service industries of low energy consumption and low carbon emissions have become a global trend and will tremendously impact future demand for bulk commodities.

However, the market faces the conflict that the supply of capital goods is sufficient in the short term but resources are scarce in the long term. In recent years, low interest rates and the scramble for resources have stimulated investments in energy and mineral resources and rapidly increased production capacity in these fields. This has alleviated short supply in previous years and even caused excessive supplies of some commodities.

At present, capital liquidity offers less support for the commodity market, weakening the impetus for prices to soar just as they did in the past few years. Stimulating economic growth has become the top priority for many countries, and unless the real economy sees continual and remarkable improvements, a relaxed monetary policy is unlikely to change. However, various economies must balance their moves to slash debt, reduce deficits, control inflation and maintain economic growth, and are therefore unlikely to release liquidity on a large scale. On the other hand, quantitative easing is becoming less effective in influencing the commodity markets, and the bulk commodity market has been less attractive to the capital markets.

"For the above reasons, in this year and the next bulk commodity prices will see neither sustained growth nor a significant drop. Prices will fluctuate frequently, but the long-term tendency is positive," said Zhang.

This indicates that in the coming two years, although a price fall will continue in China, the economy won't run into a hard landing.

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Xi vows bigger stride in space exploration

US 'stole' China's statistics

Mandela's condition critical

Suspect in shooting spree detained

Mountaineers killed in Pakistan

Foreign firms eye new 'opening-up'

Project halted due to bird nests

Man gets death for killing 7 in 9 days

US Weekly

|

|