The case for deposit insurance

Updated: 2013-10-22 07:24

By Hu Jiye (China Daily)

|

||||||||

Deposit insurance is considered to be a highly important mechanism to prevent bank runs and to boost depositor confidence. China is the only major economy in the world that has yet to introduce deposit insurance legislation after 111 countries and regions have already done so.

With the marketization of financial fields in China, establishing an explicit deposit insurance plan must be seriously considered by the central government.

For a long time, an implicit deposit insurance policy has existed based on governmental credit guarantees provided via the People's Bank of China, the country's central bank.

A good example was the takeover of Hainan Development Bank, a local mixed-ownership bank in Hainan province. After the real estate bubble burst in Hainan in the 1990s, Hainan Development Bank could not recover all of its loans - a large number of depositors took their savings to other State-owned banks starting from the spring of 1998.

The 3.4 billion yuan ($557 million) emergency aid package from the PBOC was not enough, and on June 21, 1998, the central bank had to announce the closure of Hainan Development Bank.

In the period from 1997 to 1998, the PBOC closed another 41 problematic financial institutions, mainly local urban or rural credit cooperatives. According to an academic calculation, reconstruction of the banking system cost China about 1.5 trillion yuan in the 1990s, accounting for 30 percent of the country's GDP in 1999. The implicit deposit insurance policy in China was a very expensive one.

Based on those lessons, and to mitigate the impact of an unexpected financial crisis, some consensus was reached indicating that a fully and effectively functioning deposit insurance plan with appropriate powers and responsibilities should be established to exert a positive impact on protecting depositor interests, safeguarding public confidence and stability, and improving a market-based exit mechanism for financial institutions.

Which institutions should join the plan?

In China, the top-five State-owned commercial banks have a government-based reputation in the financial market, and in the public eye they hardly have insolvency risks, so the top-five banks would not be inclined to join such a plan. Also, the top-five banks are all listed companies; hence they must create value for their shareholders, including foreign investors. An implicit deposit insurance plan uses the taxpayers' money to subsidize the bank's shareholders and depositors.

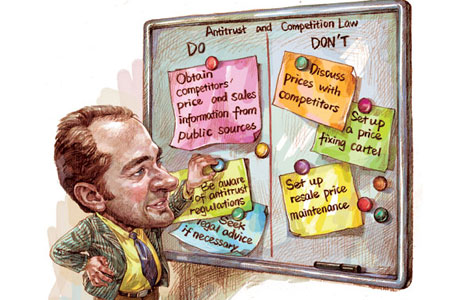

Most of the failed banks were relatively small or medium-sized local deposit-taking financial institutions. Such banks would be inclined to join a deposit insurance plan. But given their small share of the deposit market, the premiums they would pay into the insurance fund would be smaller as well. To avoid an unsolvable adverse selection problem - only risky institutions would join the deposit insurance plan - the plan would have to be universal and mandatory. The plan should therefore cover all deposit-taking financial institutions.

What will the minimum coverage level be?

Critics of deposit insurance policies have claimed that such policies introduce moral hazard problems, which will encourage both depositors and banks to take on excessive risks: they enjoy the plan's benefits but leave costs to others. A complete protection for all deposits could lead to a moral hazard problem, so both the United States and European Union set "harmonized minimum guarantee levels" at $100,000 and 20,000 euros ($27,368) or 50,000 euros before 2008. After the 2008 global financial crisis, both the US and the EU increased their coverage amounts to $250,000 and 100,000 euros.

With more flexible interest rates on the way in China, there will likely be new bank closures in the future in the country. Using the US and the EU's deposit insurance coverage as a reference, China's minimum deposit guarantee insurance level ought to be 200,000-500,000 yuan.

How to decide on the insurance rate?

With more financial innovation, high-risk banking business activities have increased. The EU's new deposit directives require banks with different risks to contribute premiums ranging from 75 percent to 200 percent of the standard amount.

China's top-five banks need a lower insurance rate to match their high reputations. But in an initial phase, Chinese bank customers may suspect that higher insurance rates reflect higher risks, and charging risk-based contributions in the beginning may lead to the undesirable result of supporting State-owned banks. When the deregulation and privatization of the Chinese banking sector reaches the next stage, introducing risk-based premiums could be considered.

Besides answering all of the above questions, China's deposit insurance legislation must meet the interest marketization trends of the banking industry. Any time would be a good time to start a deposit insurance plan.

The author is a professor of law and finance at China University of Political Science and Law.

|

For a long time, an implicit deposit insurance policy has existed based on governmental credit guarantees provided via the People's Bank of China, the country's central bank. Provided to China Daily |

(China Daily 10/22/2013 page17)

Teacher killed, two wounded in Nevada middle school shooting

Teacher killed, two wounded in Nevada middle school shooting

Smog wraps northeast, schools forced to close

Smog wraps northeast, schools forced to close

Architect looks to the big picture

Architect looks to the big picture

Teachers, students divided over Gaokao reform plan

Teachers, students divided over Gaokao reform plan

Dogfight looms over jets

Dogfight looms over jets

Peak season for fall foliage in Beijing

Peak season for fall foliage in Beijing

Train carrying carrying oil, gas derails in Canada

Train carrying carrying oil, gas derails in Canada

30,000 turn out in Beijing Marathon

30,000 turn out in Beijing Marathon

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Teacher killed in Nevada middle school shooting

Obama vows to get website fixed

BOC-NY, IFC sign agreement

US OKs Alibaba structure

UK official looks to China

Economy to see 'good ending' in Q4

Beijing needs to be 'more active' in global security

Border agreement to boost ties

US Weekly

|

|