Australian resource boom not to go bust due to China

Updated: 2014-01-13 09:42

(Xinhua)

|

||||||||

And, according to QE Innovations it is chewing on an expected further by 15 million tons in the 2013-14 financial year.

Yet, while the volume of coal shipments has been up, the weaker lower are expected to put a strain on revenue, opening up opportunity for buyers, with the shrewd cartels out of China, expected to capitalize.

Thermal coal shipments are reported to have risen 3.1 percent to 50.1 million tons but revenue has fallen half a percent to $4 billion.

Australia has $26 billion in advanced coal mining projects and associated infrastructure, involving more than 74 million additional tons of coal production by this year .

"Less advanced" coal mine and coal infrastructure projects have a potential capital expenditure of $45 billion, according to the Australian Coal Association (ACA).

New South Wales (NSW) and Queensland remained the main producing states with around 97 percent of Australia's output of black coal, and almost all of Australia's black coal exports.

"It is very encouraging to see this level of long term investment in the market in a period which has been considerably challenging for coal suppliers, contractors and the sector as a whole," he said.

Meanwhile, shares of iron miners have jumped here, following a continually positive perspective on China - Australia's key trading partner and the foundation of the mining boom that has powered Australian growth and seen two trade push past $100 billion in the last few years.

In fact, Johnson argues, it is China's consistent growth, its forward-looking infrastructure projects and the successful urbanization that has allowed coal forecasters to remain bullish and watch supply constraints to guard against instability.

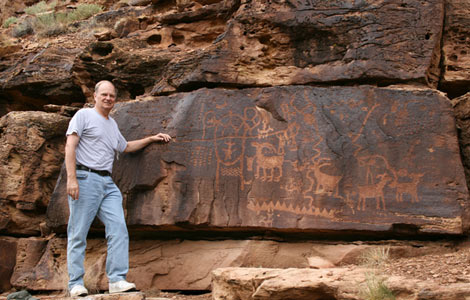

Johnson, who leads a small and diverse group of engineers involved in the design of mining technologies, told Xinhua that black coal mining in Australia has increasingly become world-leading and sophisticated, high-tech activity.

"The coal industry here is supported by a strong equipment and services sector. Australia has world-class expertise in design, construction and operation of mines, transport systems and loading facilities. It also has expertise in training, technical support and project management."

The mining investment boom curtain was supposed to have fallen last year but export earnings and the contribution to public revenue are not declining as iron ore, coal and other observers have noted according to East & Partners' iron ore and coal (IOC) index.

Should the energy giant go ahead, Kingho's maiden investment in Australia reflects a traditionally long-term outlook which will subsequently allow the group to diversify its resource base with a reportedly itchy checkbook of just under $1 billion to go shopping with.

An investment pattern with very Chinese characteristics that QE Innovations believes may yet add some bang, to a familiar boom.

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Rich Chinese tourists looking to space

Deals 'blow' against separatists

Sharp fall in tourism hits Beijing

Sharon's legacy full of contradictions

Lenovo targets US, but when?

Embraer extends coverage in China's aircraft market

Japan tries to justify shrine visit

Culture sets the beat for ties

US Weekly

|

|