China to push on with capital account opening: central bank deputy chief

Updated: 2014-11-04 11:07

(Agencies)

|

||||||||

China will advance the liberalization of its capital account by encouraging funds to enter or leave its borders and allowing foreign investors to participate in domestic mergers and acquisitions, the deputy chief of the central bank said.

Deputy Central Bank Governor Yi Gang said China will also relax the restrictions for Chinese investing overseas so that individuals and companies can play a leading role in foreign investment.

Opening the capital account is one of the hardest financial reforms that China is pursuing as it requires authorities to cede control in parts of the economy, and the fear is that the change may destabilize markets if it happens prematurely.

There was also speculation that China may delay some of its reforms to focus on bolstering the country's cooling economy, though the government has never publicly acknowledged that such a move is on the cards.

Instead, Yi said in his piece entitled "A profound understanding of the new trends in China's economic development" that China will persevere in market-oriented reforms, which are meant to reduce state planning and its attendant waste.

Yi, who also heads the agency that manages China's $3.9 trillion foreign exchange reserves, made the remarks in an opinion piece that ran in the ruling Communist Party's official People's Daily newspaper on Monday.

The government will create a set of rules that are open and transparent and write a "negative list" that says which industries are out of bounds for foreign investors, he said.

There were no direct comments on China's plans to free the yuan and turn it into a convertible currency, or one that can be moved in and out of the country with few restrictions.

Beijing has made reforming China in a host of areas one of its policy priorities this year, although the job has been made difficult by a slowdown in the world's second-largest economy.

Economic growth slipped to its slowest since the 2008/09 global financial crisis in the third quarter and annual expansion is expected to sag to a 24-year low of 7.4 percent in 2014, according to analysts polled by Reuters.

|

|

| Capital account risks 'can be managed' | Capital account swings to surplus in 2013: SAFE |

- Jordan recalls envoy to Israel over Jerusalem 'violations'

- Hamas claims responsibility for drive-over car attack in Jerusalem

- Jump over the ruins

- Mongolian PM fired by parliament, leading to govt collapse

- Chinese premier to attend East Asia leaders' meetings, visit Myanmar

- Kerry urges greater US-China co-op in major global issues

Rehearsal of firework show for APEC staged in Beijing

Rehearsal of firework show for APEC staged in Beijing

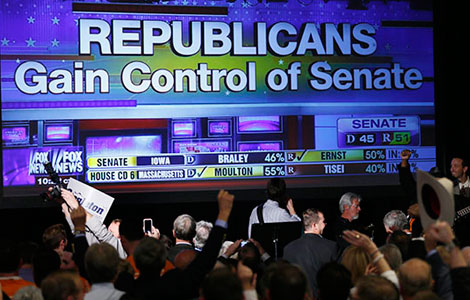

Republicans capture control of Senate in US midterm elections

Republicans capture control of Senate in US midterm elections

Chinese students compete in real estate challenge

Chinese students compete in real estate challenge

Trending across China: Abortion lesson horrifies kids

Trending across China: Abortion lesson horrifies kids

Jump over the ruins

Jump over the ruins

8 things you should know about 'Double 11'

8 things you should know about 'Double 11'

Culture Insider: What books do politicians like?

Culture Insider: What books do politicians like?

WTC reopens with six-floor China Center

WTC reopens with six-floor China Center

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Republicans gain seats in Senate

Chinese Americans run in elections across US

Mobile gains buoy Alibaba earnings

Kerry, Cui reaffirm bilateral ties

Republicans capture control of Senate

China develops laser system against drones

Students compete in real estate challenge

FDA beefs up China office

US Weekly

|

|