Chinese actress buys 9% stake in Alibaba Pictures

Updated: 2015-01-27 13:10

By Dai Tian(chinadaily.com.cn)

|

|||||||||

The e-commerce behemoth acquired a 60 percent stake in Hong Kong-listed ChinaVision Group for $804 million in March last year. The company, now named Alibaba Pictures Group, produces Chinese-language TV shows and movies.

Alibaba Group has its own digital entertainment arm within the company, responsible for businesses such as mobile games and music-streaming service Xiami, according to Reuters.

Related Story:

Sale of Alibaba stake 'will cut Yahoo down to size' by Agencies

Yahoo Inc will be a fraction of its size should the company spin off its remaining stake in Alibaba Group Holding Ltd, making it a takeover candidate for SoftBank Corp or private equity firms.

Marissa Mayer, chief executive of the $46 billion company, is expected to give an update next week about whether Yahoo will sell its Alibaba shares and how it will avoid paying taxes on the move.

With the Chinese e-commerce company accounting for most of Yahoo's value, shareholders would be left holding a United States-based Internet advertising and search business worth about $5 billion to $8 billion, according to analysts' estimates compiled by Bloomberg.

Yahoo will also still have a roughly $8 billion stake in Yahoo Japan Corp.

SoftBank could buy Yahoo to increase its own Yahoo Japan stake, though it is unclear how much the Japanese wireless carrier would be willing to pay for a US business that is under pressure.

A private equity suitor could be lured by the cash Yahoo's operations generate.

Or Alibaba could always just take over Yahoo and retire the Alibaba stock that Yahoo owns, gaining some exposure to the US technology market.

"Marissa Mayer has to make a very big decision, and it will either involve splitting the company up or doing nothing," Neil Doshi, a San Francisco-based analyst for CRT Capital, said. If it casts off the Alibaba stake, "the acquisition size becomes much more manageable, and we think Yahoo could become a much more compelling target."

Mayer said in October that she will report back to shareholders by the next earnings release on Jan 27 with an update on its plans for the rest of its Alibaba holding.

"Many have pointed out the value accretion that would occur if this final tranche were to be taxed upon sale at a lower rate than the previous sales," Mayer said at the time. "We are acutely of aware of this. We have the best tax experts in the country, working intensively on structures to maximize the value to our shareholders of our remaining stake in Alibaba."

Northeastern US braces for 'crippling' blizzard

Northeastern US braces for 'crippling' blizzard

At least 2 dead, dozens hurt after bus hits road barrier

At least 2 dead, dozens hurt after bus hits road barrier

Red carpet of 21st annual SAG Awards in Los Angeles

Red carpet of 21st annual SAG Awards in Los Angeles

New Year celebrated with dance mix

New Year celebrated with dance mix

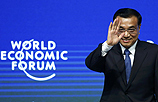

Businesswomen shine at the World Economic Forum

Businesswomen shine at the World Economic Forum

Dogs compete at the Siberean Cup

Dogs compete at the Siberean Cup

The world in photos: Jan 19-25

The world in photos: Jan 19-25

Drama with a twist

Drama with a twist

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Beijing gears up for Super Bowl

Rock-Paper-Scissors: Paper wins

10 million new jobs on way in China, Li vows

Chinese plan NJ's tallest building

Obama's trip to India spurs triangle chatter

Motorola to make phones in Tianjin

High abortion rate triggers fears for young women

Small drone crashes on White House

US Weekly

|

|