Slow growth may spur more support

Updated: 2015-09-14 06:45

By Chen Jia(China Daily)

|

||||||||

|

|

A worker welds at a construction site in Yiliang, Yunnan province, February 28, 2015.[Photo/Agencies] |

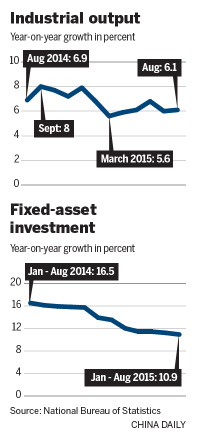

The National Bureau of Statistics said on Sunday that industrial output, the main monthly growth measure, rose to 6.1 percent year-on-year last month, up from 6 percent in July, but short of expectations of 6.5 percent.

On Friday, Premier Li Keqiang sent a message to the world at the "Summer Davos" forum in Dalian, Liaoning province, that a slower growth rate is acceptable unless there is turbulence in the job market. Measures introduced to date are sufficient to prevent an economic "hard landing".

In an attempt to inject long-term growth momentum into large State-owned enterprises, the State Council, or the Cabinet, has released a guideline on further reforming their ownership and stimulating market vitality.

Fixed-asset investment increased to 10.9 percent in the first eight months compared with a year earlier, slower than the 11.2 percent from January to July.

Retail sales rose by 10.8 percent in August, compared with 10.5 percent in July, the bureau said.

An independent calculation by Bloomberg shows that China's GDP growth rate may have been 6.6 percent in August, unchanged from July, but slower than the 7 percent in the first six months, said Tom Orlik, an economist at the news agency.

According to the statistics bureau, in the first half of this year the number of jobs grew by more than 7.18 million, compared with the target of 10 million set for the year.

However, the manufacturing and service purchasing managers' indexes released earlier showed employment contracting last month.

Qu Hongbin, chief China economist at HSBC Holdings, said a long-term economic slowdown is harmful to companies' confidence, which may lead to a wave of bankruptcies and sharply reduce job opportunities.

"Industrial production faces a grim situation, requiring more policy easing," Qu said. He expects infrastructure construction and real estate growth to speed up, which may support a modest economic rebound.

Man tries to sell kidney for iPhone 6s

Man tries to sell kidney for iPhone 6s

Gems of Chinese painting at Sotheby's HK auction

Gems of Chinese painting at Sotheby's HK auction

NYFW: Tommy Hilfiger Spring/Summer 2016 collection

NYFW: Tommy Hilfiger Spring/Summer 2016 collection

Bus decorated with 3D painting goes into service

Bus decorated with 3D painting goes into service

Top 10 tire companies in the world

Top 10 tire companies in the world Djokovic beats Federer to win second US Open title

Djokovic beats Federer to win second US Open title

The world in photos: Sept 7-13

The world in photos: Sept 7-13

Hanging in the air: Workers risk life on a suspension bridge

Hanging in the air: Workers risk life on a suspension bridge

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Parade attendees tell Houston of honor

Boeing plan for finishing center to stir up China market

Illegal margin debts probe won't crash markets: CSRC

Prisoners on death row to get free legal aid

Kissinger anticipates promising China-US ties

Germany re-imposes border controls to slow migrant arrivals

Thousands flee California wildfire as homes go up in flames

Museum crowds wait six hours to see ancient scroll

US Weekly

|

|