VAT to ease firms' burden, boost growth

Updated: 2016-04-28 07:59

By Yang Zhiyong(China Daily)

|

||||||||

|

|

People enter a taxpayer service hall in Beijing, Dec 13, 2010. [Photo/IC] |

China will replace business tax with value-added tax, or VAT, from May 1 in what is seen as a major taxation reform. The move will reduce the government's tax revenue by more than 500 billion yuan ($76.99 billion), but simultaneously it will ease the tax burden of enterprises. In this sense, the tax reform shows the government is serious about helping enterprises tide over the tough economic situation and further stabilize the macroeconomy.

The replacement of business tax with VAT will eliminate multiple taxes on the same products and help the market play a more decisive role in resource distribution. The pilot program of replacing business tax with VAT will be extended to the remaining four sectors-property, construction, finance and consumer services-to cover all goods and services. VAT will be levied with different tax rates to ensure the implementation of the tax reform and ease the tax burden on various industries.

Also, real estate input tax deduction is an important part of the overall pilot reform.

Propelling the all-round pilot reform is not an easy task, however, because it involves so many industries. To push forward the reform, therefore, the national tax authority and local tax bureaus have to deepen their cooperation.

Business tax is mainly local tax in nature. For tax collection and management, however, local tax bureaus have to employ huge human, physical and financial resources. So after the pilot reform of replacing business tax with VAT, the national tax authority's workload will greatly increase, because this round of trial reform will involve more than 11 million enterprises and over 2 trillion yuan in tax revenue.

VAT collection and management, however, can become easier if local tax officials, who have abundant experiences in the field, closely cooperate with the national tax authority. After all, one of the main reasons for the tax reform is to integrate national and local taxes in order to improve tax services and reduce taxpayers' burden.

- VAT reform to reduce 20% of hotel tax burden

- Sensible ways to stop tax evasion

- New tax rule may cool ardor for cross-border purchases

- China's Q1 tax revenue up 9.8%

- Tax harmony in China: A lesson for the US

- Law of the People's Republic of China on Individual Income Tax

- Tax policy won't derail online retail sector

- Li: Central govt to decide local share of new tax

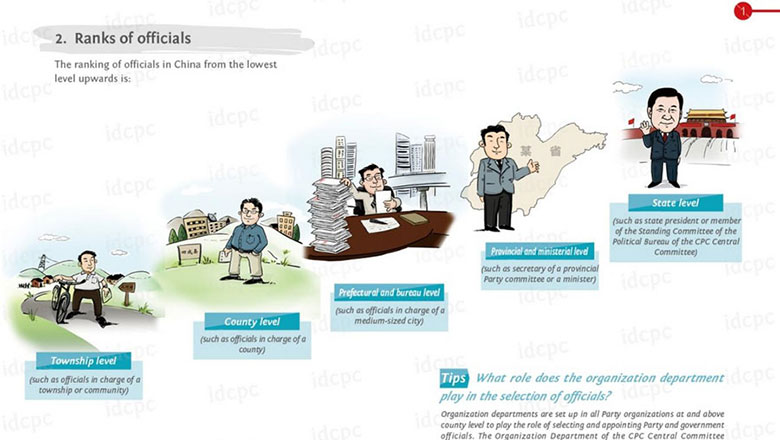

CPC creates cartoon to show how officials are selected

CPC creates cartoon to show how officials are selected

Top 5 expected highlights at CES Asia 2016

Top 5 expected highlights at CES Asia 2016

Business jet market hits air pocket

Business jet market hits air pocket

Canada getting on top of Alberta wildfire, Fort McMurray off limits

Canada getting on top of Alberta wildfire, Fort McMurray off limits

Young golfers enjoy the rub of the green

Young golfers enjoy the rub of the green

71st anniversary of victory over Nazi Germany marked

71st anniversary of victory over Nazi Germany marked

Post-90s girl organizes others’ messy wardrobes

Post-90s girl organizes others’ messy wardrobes

Landslide hit hydropower station in SE China

Landslide hit hydropower station in SE China

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Liang avoids jail in shooting death

China's finance minister addresses ratings downgrade

Duke alumni visit Chinese Embassy

Marriott unlikely to top Anbang offer for Starwood: Observers

Chinese biopharma debuts on Nasdaq

What ends Jeb Bush's White House hopes

Investigation for Nicolas's campaign

Will US-ASEAN meeting be good for region?

US Weekly

|

|