Yuan elevated to elite club of currencies

Updated: 2016-10-02 13:22

By Wang Yanfei

|

||||||||

The inclusion of the renminbi among the elite reserve currencies of the International Monetary Fund over the weekend will push ahead reforms linked to the currency's internalization and marketization, according to economists. They also discounted speculation it would prompt a sharp depreciation of the currency.

The IMF approved the yuan as the fifth elite currency to join the special drawing rights basket, which is a foreign exchange reserve asset that includes the US dollar, euro, yen and the British pound.

"The RMB's acquisition of SDR status marks a milestone, which is equivalent to that of China's entry into the World Trade Organization in 2001," said He Zhicheng, former senior economist with the Agricultural Bank of China.

"But it only marks the beginning on its journey to become a global reserve currency," He said. "It would prompt the government to move ahead with reforms in the financial sector."

The renminbi has leapfrogged other currencies to occupy the third-largest share of the new SDR basket at 10.92 percent, following the US dollar's 41.73 percent and the euro's 30.93 percent.

Rising demand for yuan assets brought by inclusion in the SDR basket will push China to deepen reform and the internationalization of yuan, at a time when China is becoming more integrated into the global market, according to Zhao Xueqing, an economist with the Institute of International Finance, a think tank affiliated with the Bank of China.

The renminbi has been the fifth-most-used currency for global payments for the second consecutive month, according to SWIFT, the global transaction service.

Yuan-dominated direct investment saw rapid growth from January to August, when the total reached 1.62 trillion yuan ($242 billion), up 61.7 percent year-on-year.

Over the past decade, the world has witnessed the rapid rise of the Chinese currency.

But the SDR inclusion's impact on the government's tightening of controls over the yuan's exchange rate will be rather minimal, according to Sun Lijian, an economics professor with Shanghai-based Fudan University.

Sun played down speculation that the central bank would allow a sharp depreciation right after the yuan's inclusion.

Depreciation pressure

While the yuan does face a certain level of depreciation pressure against the US dollar, mainly driven by a potential US interest rate hike in December, it "does not face long-term depreciation pressure", he said.

"The RMB's inclusion into the SDR basket, with its rising status as global currency, can be a hedge against the pressure of depreciation, if anything," he said, referring to the fact that capital inflows brought by increasing demand for yuan assets would help stabilize the exchange rate.

Lian Ping, chief economist with Bank of Communications, shared similar views and said that the yuan's exchange rate depends more on the fundamentals of the economy and market expectations.

wangyanfei@chinadaily.com.cn

Top 10 Chinese cities with 'internet plus transportation’

Top 10 Chinese cities with 'internet plus transportation’

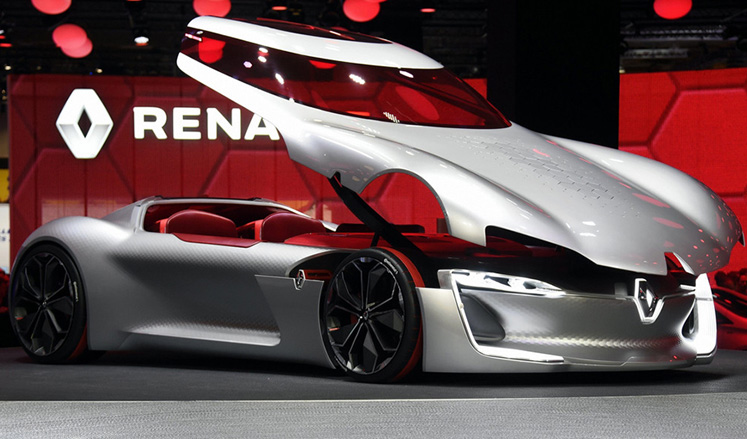

New energy cars shine at Paris Motor Show

New energy cars shine at Paris Motor Show

23 baby giant pandas make debut in Chengdu

23 baby giant pandas make debut in Chengdu

Heritage list salutes Chinese architecture

Heritage list salutes Chinese architecture

Happy hour for prince and princess in Canada

Happy hour for prince and princess in Canada

Chinese and Indian sculptures on display at the Palace Museum in Beijing

Chinese and Indian sculptures on display at the Palace Museum in Beijing

Rescue work at the typhoon-hit provinces

Rescue work at the typhoon-hit provinces

Wonderland-like sunrise in East China

Wonderland-like sunrise in East China

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

US Weekly

|

|