Capital flows moving from real estate

Updated: 2016-10-11 07:39

By WU YIYAO(China Daily)

|

||||||||

Limits on residential property purchases are driving capital flows into stocks, resulting in immediate, short-term increases in stock prices in China's A-share market, analysts said on Monday.

As many as 20 cities have pushed up their thresholds for home purchases, including setting higher down payment requirements and narrowing the definition of qualified buyers. More cities are on their way to introduce similar measures to curb fast growth of average housing prices and to limit speculative buying.

Li Xunlei, an economist with Haitong Securities, said that the measures against speculative buying aimed to deleverage the property market.

"A part of the capital withdrawn from the property market will go to the stock market, which has investors with more tolerance for risks and more liquidity," said Li.

Qiao Yongyuan, an analyst with Guotai Jun'an Securities, said that it was a natural result for capital owners to divert money from one market to another when policy makers were cooling down the overheated property market and the stock market was on track for recovery.

However, the impact would not last long because the entire size of capital flows from property to stocks was limited due to the low liquidity of the property market, Qiao added.

Also, the stock market still had uncertainties due to fluctuating currency exchange conditions.

Stricter policies over the real-estate market will also put pressure on the performances of A-share listed developers, according to a CITIC Securities strategy report.

Mao Liyuan, a 48-year-old Shanghai investor who sold her 85-square-meter apartment for 5.1 million yuan ($761,100) in September, said she will put about just one million into the stock market and put the rest in wealth management products and gold to diversify risks.

"You have to take a lot of stock market risks into consideration. For investors, the property and stock markets are not the only options," she said.

The A-share market closed on Monday with gains in both Shanghai and Shenzhen. The Shanghai Composite Index gained 1.45 percent to 3,048 points and the Shenzhen Component Index gained 1.65 percent to 10,471 points.

- World's longest sightseeing escalator awaits you in China

- More than 20 buried under collapsed buildings in Wenzhou

- Li arrives in Macao to boost ties with Portuguese-speaking countries

- Scenic spots ranked for their holiday services

- Illness raises risk of vanishing

- Jack Ma and Spielberg work together to tell Chinese stories

- Russia-US relations change fundamentally

- Trump assails Bill Clinton, vows to jail Hillary Clinton if he wins

- US Navy ship targeted in failed attack from Yemen

- Panel tackles Fox News skit on Chinatown

- Chinese tourists forced to sleep at airport for 5 days

- Saudi-led coalition denies striking funeral in Yemen's capital

The world in photos: Sept 26 - Oct 9

The world in photos: Sept 26 - Oct 9

Classic cars glitter at Berlin motor show

Classic cars glitter at Berlin motor show

Autumn colors in China

Autumn colors in China

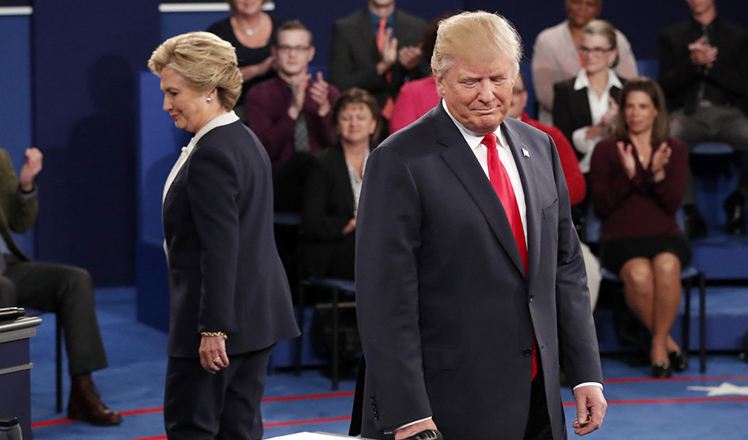

US second presidential debate begins

US second presidential debate begins

Egrets Seen in East China's Jiangsu

Egrets Seen in East China's Jiangsu

Highlights of Barcelona Games World Fair

Highlights of Barcelona Games World Fair

Coats, jackets are out as cold wave sweeps in

Coats, jackets are out as cold wave sweeps in

6 things you may not know about Double Ninth Festival

6 things you may not know about Double Ninth Festival

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

US Weekly

|

|