Stability for yuan seen in long run

Updated: 2016-10-19 23:15

By Wang Yanfei(chinadaily.com.cn)

|

||||||||

Steadily recovering economy to give strong support, NBS spokesman says

A strong dollar and external uncertainties are creating pressure for short-term depreciation of the yuan, but economic fundamentals will help stabilize the exchange rate in the long run, the spokesman for the National Bureau of Statistics said on Wednesday.

The onshore exchange rate rose for the first time in nine days after data on Wednesday showed that the nation's economic growth expanded by 6.7 percent year-on-year in the first three quarters of the year, easing some concerns of continued deprecation.

"Recent depreciation of the yuan was mainly driven by external factors, where rising expectations of interest rate hikes in the United States and uncertainties brought by the slowly recovering global economy played major roles," said Sheng Laiyun, spokesman for the NBS, "but the currency does not face medium- to long-term depreciation pressure."

"A steadily recovering economy would be the strongest support for a relatively stable exchange rate," he said, adding that a trade surplus would also fend off the risks of a further substantial depreciation.

Xu Gao, chief economist of China Everbright Securities Co, said the market has become accustomed to two-way volatility.

"Although the yuan has room for depreciation in the short run, it will not enter a depreciating path because recovery of the economy in the United States remains weak," Xu said.

Xu made the remarks after the yuan fell sharply versus the dollar in the past two weeks, following the yuan's inclusion in the Special Drawing Rights basket of the International Monetary Fund at the beginning of the month.

Market watchers expected a sharp depreciation soon after the SDR inclusion, considering that policymakers need to further liberalize the exchange rate controls.

Sheng said the SDR inclusion can help stabilize the exchange rate, since it will prop up the demand for the yuan in the international market.

"Central banks will raise the demand for the yuan after it becomes a reserve currency," said Sheng.

Bu Yongxiang, deputy director of the research institute of the People's Bank of China, the central bank, said the short-term impact brought by the SDR inclusion on exchange rate fluctuation will be minimal.

"The message is that it marks a new start for China in deepening reform in the financial sector and boosting capital-account convertibility, and further strengthens our exchange rate policy and makes it more market-oriented, flexible and transparent," he said.

Soundbites

Marie Diron, associate managing director at Moody's Investors Service

|

|

File photo of Marie Diron [Photo/China Daily] |

Direct and indirect policy stimulus continued to support real GDP growth at a steady 6.7 percent rate in the third quarter. Very rapid growth in sales of commercial and residential buildings is likely, partly related to measures implemented in the last two years to ease access to mortgages. Although household debt is currently low, increased reliance on construction and real estate activities exposes the economy to a reversal in these markets. Rebalancing is continuing gradually, and we expect the economic growth to stay around 6.5 percent this year as policy support continues to bolster economic activity.

Wang Tao,chief China economist at UBS

|

|

File photo of Wang Tao [Photo/China Daily] |

More targeted property cooling measures are possible if buyer sentiment in overheated cities does not ease more visibly soon. The government may not push much more on fiscal policy until growth weakens visibly, which may not be until year-end, around mid-December's annual Central Economic Work Conference. Given recent policymakers' recent property bubble and rising leverage concerns, and the fact that this year's GDP target looks set to be met without much need for additional quasi-fiscal support, neither do we expect any notable credit acceleration or interest rate cut by year-end.

Jeremy Stevens, chief China economist at Standard Bank

|

|

File photo of Jeremy Stevens [Photo/China Daily] |

The government will have fiscal and monetary space if needed to support the economy, should the private sector not bounce from the current lows. In addition, construction in tier one and two cities may also be supportive given that inventory levels will be back at 2011 levels by the end of this year. The immediate risk is that capital outflows and the yuan's depreciation pressures could complicate the policy mix.

Duncan Freeman, research fellow, EU-China Research Centre, The College of Europe

|

|

File photo of Duncan Freeman [Photo/China Daily] |

The figure of 6.7 percent GDP growth is a respectable outcome in the current domestic and external situation of the Chinese economy, but more important than the overall GDP growth figure are some of the underlying trends. The continuing shift toward growth driven by services indicates that structural changes in the economy are occurring. One of the key elements in the latest figures is the strengthening of inflation and producer prices, and the reversal of price deflation is important for the profitability of companies, and the implied rise in nominal GDP growth, if it is sustained over the long term, will be an important factor in the reduction of China's high ratio of debt to GDP.

Fredrik Erixon, director of the European Center for International Political Economy in Brussels

|

|

File photo of Fredrik Erixon [Photo/China Daily] |

China's economic growth rate has stabilized at a lower level and follows the expectation about and consequences from its economic transition. Though several uncertainties cloud the outlook for 2017 and 2018, China has great opportunities to increase growth by unleashing more productivity in the economy. Productivity growth has been declining for some time, but more economic reforms of markets would allow for productivity growth to go up again.

Luigi Gambardella, president ChinaEU, a Brussels-based organization that boosts exchanges in the telecommuncaiton and internet and digital economy exchanges

|

|

File photo of Luigi Gambardella [Photo/China Daily] |

The rate of growth of China remains stable and solid. Many other countries would dream of having that kind of growth. We believe there are two formidable engines which will support the growth of China: digital and green economy. Thanks to the investments in technology and research, China will become the leader in these two important sectors. 5G, robotics, drones, artificial intelligence, big data and only few examples of the potentiality of digital to transform the Chinese economy.

Glimpse into lifestyle of astronauts in space

Glimpse into lifestyle of astronauts in space

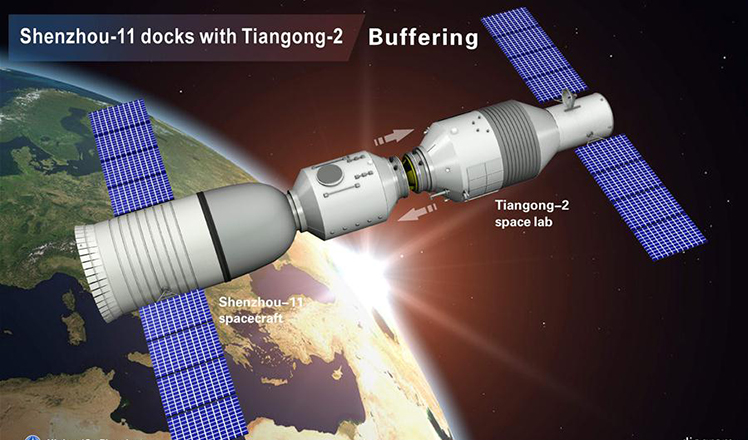

Shenzhou XI spacecraft docks with Tiangong-2 space lab

Shenzhou XI spacecraft docks with Tiangong-2 space lab

Typhoon Sarika makes landfall in South China

Typhoon Sarika makes landfall in South China

Handmade coarse cloth gets new shine

Handmade coarse cloth gets new shine

World in photos: Oct 10 - 16

World in photos: Oct 10 - 16

Fairing fragments of Shenzhou XI found in Shaanxi

Fairing fragments of Shenzhou XI found in Shaanxi

Feast for the eyes: Photo Beijing 2016

Feast for the eyes: Photo Beijing 2016

China's Shenzhou spaceship: A proud family

China's Shenzhou spaceship: A proud family

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

'Zero Hunger Run' held in Rome

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

US Weekly

|

|