Renminbi steadier as central bank's remedies take hold

|

|

An employee at a bank counter in Nantong, Jiangsu province, counts renminbi and dollars. [Photo/China Daily] |

Short sellers may find it more difficult to score profits from betting on a continued depreciation of the yuan, according to economists, who said measures rolled out by the central bank to stabilize market expectations have begun to take effect.

Faced with pressure from capital outflows and a further possible decline in forex reserves, the central bank also might use what is known as window guidance or jawboning-which could be indirect persuasion through market-oriented measures-both onshore and offshore to curb the market's expectations of a sustained depreciation of the yuan, they said.

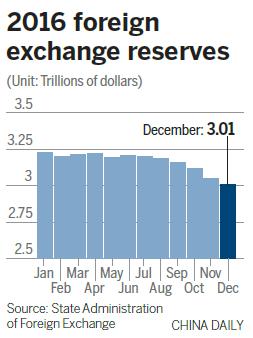

Forex reserves fell by $41 billion in December from the previous month to $3.01 trillion, the lowest level since March 2011, almost hitting the $3 trillion psychological line that the central bank tolerates, as some media reports have put it.

"The current level of forex reserves is still way above what the nation needs to cope with external financial risks," said Zhao Qingming, an economist with China Financial Futures Exchange.

A close look at the change in capital flows as shown in forex reserves data shows a slew of recent measures have taken effect, according to a report released Sunday by Chinese investment bank CICC. It referred to measures like strengthened supervision for overseas investment projects and foreign acquisitions.

Capital outflows in December amounted to $30.9 billion, far lower than the $46.2 billion in November, according to the report's estimate.

The offshore yuan jumped 2.6 percent in two days last week, the biggest gain against the greenback since 2010.

The central parity rate of the yuan strengthened against the US dollar on Friday and stood at 6.8668, the highest level in over a month.

Xie Yaxuan, chief economist at China Merchants Securities, said the yuan's recent surge has perplexed speculators who expected a sustained depreciation.

"It will be more costly for speculators to bet on depreciation of the yuan," said Xie, adding that the central bank has enough tools to choose from to curb speculative behavior if a further drop in forex reserves leads to capital flight pressures.

Wang Youxin, an economist at the Institute of International Finance affiliated with the Bank of China, said apart from selling dollars in the forex market, the central bank is able to use more market-oriented approaches to curb depreciation expectations. Such measures include tightening liquidity and boosting interest rates, thus raising the opportunity costs of capital outflows.

Ren Zeping, chief economist of Founder Securities, said the warming up of the domestic economy and weakening of the dollar index help create an environment for stabilizing the yuan.

In the long-run, the central bank may need to allow a completely free fluctuation of exchange rates to avoid a recurrence of depreciation expectations, according to Liu Jie, an economist with China Minsheng Securities.